Before getting started with this edition of the Restaking Synopsis, we’d like to take a moment to highlight our uniqueAVS Selection Framework, that we announced on Thursday, May 9th!

TL;DR:

Since EigenLayer launched, operators have been busy onboarding every AVS out there. But there’s only 1 problem with that - this may not be a wise long-term approach.

We've detailed why in an article (linked below), and to summarize, here's what sets our approach apart:

🛑 No "Onboard All" Promise: We prioritize AVSs with breakout potential, filtering out those with complexity and risk.

✅ Rigorous Criteria: Our selection filters are based on strict engineering, security, and economic factors.

🎖Quality Over Quantity: Only AVSs that meet our criteria will be onboarded.

This reflects our customer-first principle and long-term vision for the EigenLayer ecosystem.

Feel free to check out the full article for more details on our AVS Selection Framework, why we're taking this unique approach, and why this approach is an important consideration for EigenLayer users.

Read the entire article here: https://chorus.one/articles/the-chorus-one-approach-to-avs-selection

🌟BONUS: Here's a meme-thread explanation of our AVS Selection: https://x.com/ChorusOne/status/1788928433461903496

OPUS Pool enables you to seamlessly stake ETH, restake a variety of LST’s and delegate your restaked assets to Chorus One on a single platform.

✅ Stake, Restake, and Delegate using just a few, simple clicks

✅ Completely permissionless

✅ Easily view/download your entire historical staking rewards report

✅ View and track your restaked asssets

✅ All on a single platform

Visit OPUS Pool: https://opus.chorus.one/pool/stake/

Your guide to OPUS Pool: https://chorus.one/articles/your-guide-to-opus-pool-stake-mint-oseth-and-restake-with-eigenlayer

As of May 10, you can claim your EIGEN, restake it (if you haven’t already) and choose to delegate to an EigenLayer Operator for future rewards!

The steps?

1. Claim EIGEN here: http://claims.eigenfoundation.org

2. Restake it (if you haven’t already): http://app.eigenlayer.xyz/restake/EIGEN

3. Delegate your restaked assets to Chorus One: https://app.eigenlayer.xyz/operator/0xf80b7ba7e778abf08a63426886ca40189c7ef48a

Note: You can currently only restake and delegate your EIGEN via the EigenLayer dashboard.

If you’re interested in learning more about staking/restaking with Chorus One, simply reach out to us at staking@chorus.one and we’ll be happy to get back to you!

Additionally, if you’d like us to share further resources on any topic, please let us know!

Thanks for reading and see you next time!

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Our EigenLayer strategy is to onboard all the AVSs that have chances of being break-out winners, while filtering out the long tail of AVSs that introduce complexity and risk. With this combination, we aim to deliver the best risk-adjusted reward APY to users delegating their restaked assets to by Chorus One. The first section covers our thesis, the second our onboarding policy and the third our track record.

The EigenLayer ecosystem will have hundreds of AVSs and be the leading mechanism for Ethereum to scale and service billions of users.

We expect individual AVSs to follow a power law distribution in competency and success, similar to the patterns observed elsewhere in crypto. For Cosmos, an application-specific ecosystem similar to EigenLayer, this data-set shows 6 chains have over $1 billion circulating market cap, 16 are between $100 million and $1 billion, and 42 are under $100 million. Most Cosmos chains never achieve significant success, with market caps exceeding $100 million. The median chain barely gains traction and struggles for attention and impact. In the broader crypto market, there are ~14,000 tokens (from CoinGecko). The median token is illiquid. All the realized alpha in crypto lies in the outliers - the top 500 chains with market caps above $90 million and sufficient liquidity. AVSs will be similar - all the returns will exist in the top 20% of AVSs.

Not only are successful AVSs the exception, but there is major alpha in early participation in promising projects with no defined market value. Most AVS projects will spend significant time in a pre-launch phase where the mainnet service does not exist. Testnets are rolled out while the developers build functionality and product features. During this phase, there is no clarity on the economics of reward delivery of the AVS. There is also no market cap, token supply, or token price information to rely on. There are likely also caps on the number of operators that can be enrolled by the project developers for testing. Because of the lack of information and transparency in the market, the overall ecosystem of Node Operators (NO’s) and restakers cannot perfectly judge the project. Hence, outsized yields, can be produced. The EIGEN token delivers the best example of such an opportunity - it delivered returns to early restakers in the 30%-60% range, depending on when exactly the restakers participated and how trading markets stabilize.

It is possible (and a mistake) to onboard the entire long-tail of AVSs. Such an approach will radically boost infrastructure complexity and risk. Complexity and risk lead to the need to charge high commissions, thus reducing the risk-adjusted APY for restakers. Eventually, it accentuates slashing risk. Technical due diligence, that tests for originality and legitimacy of software work, as well as application of software development best practices has always been and continues to be the best method for filtering out the long tail, and narrowing focus on the break-out winners.

We will apply our infrastructure effort in a subset of chains that pass our strict filtering criteria. When multiple AVSs pass our filtering criteria concurrently, our internal prioritization will look at the positive signals from the projects.

Our filtering criteria focuses on evaluating the software engineering of projects. Our method for evaluation consists of 3 parts:

Our filtering criteria focuses not on the easily molded exteriors of the project - the website, the podcasts or the marketing - but rather on the hard to change signal-rich factors that usually accompany a winning project in crypto.

When multiple AVSs cross our filter and require prioritization, we will prioritize them depending on the following signals:

We’ve applied a similar framework for our onboardings across Cosmos and in our venture investments. Chorus One is the most successful validator venture investor counting early participation in Solana, Lido, Celestia, Dymension, Saga, Wormhole, GogoPool, Neutron and Osmosis. In addition, we have infrastructure certifications highlighting the care with which we operate the networks.

Cosmos is the best example of an alternative application specific eco-system similar to EigenLayer. Our selection process, applied over 6 years has consistently picked all the top 20 chains, except two. On Cosmos, we have the best track record on participating with the governance processes of application specific chains.

Our early experience in EigenLayer, which includes research on network wide risk and slashing cascades, reinforces our belief in our onboarding process. We’ve encountered AVSs with plagiarized code, closed source code, and AVSs with key management systems that would expose our entire EigenLayer setup (operator key) to attack. These experiences have made it impossible for us to follow an “onboard all AVSs” path.

As a restaker with Chorus One, you derive the following benefits with our approach:

We will never be the operator with the most number of AVSs onboarded. And that works because it is far more critical to be early supporters of the break-out successes. Here’s to finding the gems early!

Seamlessly restake with Chorus One using OPUS Pool: https://opus.chorus.one/pool/stake/

Here's a step-by-step guide to using OPUS Pool: https://chorus.one/articles/your-guide-to-opus-pool-stake-mint-oseth-and-restake-with-eigenlayer

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

As Ethereum restaking gains momentum, we wanted to take a moment to enumerate some of the risks that you as a user might be exposed to when choosing to restake your tokens. While restaking’s innovative consent can offer benefits to Ethereum staking, like generating more value for your staked tokens, it is also important to think clearly and consider some of these potential risks:

Slashing

As with any staking activity on Ethereum, your pledged ETH is subjected to networks rules that can result in the partial or total loss of your tokens, in the case of proven malicious activity that targets the network. Although slashing is a relatively rare occurrence (and has never happened to any of Chorus One’s validators), it is still the biggest risk you might be subjected to. When users are able to delegate tokens, they would be susceptible to slashing penalties from both Ethereum and Actively Validated Services (AVS's).

Smart contract risk

A more common source of risk is related to the smart contracts that govern the protocols and services on Ethereum, as they are susceptible to bugs on their code that can be exploited, as well as unexpected behavior under untested conditions. Projects built on Eigenlayer (like our OPUS 'Pool' restaking fuctions) ultimately secure their funds within the contracts of Eigenlayer. In the event of an attack on the Eigenlayer contract, the funds of associated projects may be jeopardized. This would be true as well of the code associated with different AVSs.

Eigenlayer has been audited twice in the past, a first audit done by Consensys Diligence, and a second audit done by Sigma Prime. You can read more about the auditing process here: https://docs.eigenlayer.xyz/eigenlayer/security/audits

Additional risks

Although the first two would be the most definitive scenarios that could have a direct effect on your restaked assets, there’s another suite of known (and possible unknown) risks that can be linked to this new technology:

Chorus One puts a premium on the security of all its users, recognizing its paramount importance in fostering trust and peace of mind. Through our comprehensive security framework, we ensure that your investments are well-protected: both, in our OPUS Pool and OPUS Dedicated products, in our underlying infrastructure, and at every step when deciding to onboard a network or protocol.

ISO 27001:2022 Certification

Chorus One adheres to stringent regulatory requirements, safeguarding your assets in accordance with data protection and privacy laws. In October 2023, we attained the coveted ISO 27001:2022 certification ensuring world-class security for all our customers.

Resilient infrastructure

We guarantee our high-quality of service with minimal disruptions, due to a strategic combination of multiple availability zones for our infrastructure; and network security procedures such as stringent access control, encrypted connections, firewall fortifications and security configurations. Our team is trained and provided with security awareness workshops to ensure our best line of defense.

Careful research process

Our dedicated research team conducts in depth due diligence on all the networks and protocols we onboard, to understand any potential risks we can be exposed to when participating on the systems. We go above and beyond to build a more security-minded ecosystem and to promote professional standards in the industry.

Learn more about Chorus One’s commitment to security here: https://security.chorus.one/

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Proto-danksharding, blobs, and data availability are terms becoming increasingly familiar in the Ethereum community, all leading up to the Dencun Upgrade – Ethereum's most significant update since Shapella.

With less than a month to the upgrade, Chorus One is here to provide you the essential information about this pivotal event, including three key staking/validator based Ethereum Improvement Proposals (EIPs) involved, with a special focus on the much-anticipated EIP-4844.

In April 2023, we explored the post-Shapella landscape in our blog article "Beyond Shapella," highlighting the significant impact of the Shapella upgrade on Ethereum staking. This upgrade introduced the flexibility to withdraw staked ETH and rewards, captivating institutional interest in Ethereum, the second-largest cryptocurrency by market cap.

The Shapella upgrade marked a turning point, boosting ETH's staking appeal among institutional investors. Since then, Ethereum's roadmap has seen several developments, leading us to the brink of another major milestone - the Dencun upgrade. This forthcoming hard fork is set to advance Ethereum's evolution, promising to tackle existing challenges and open up new opportunities.

In fact, Ethereum jumped 28% since the start of February and rose above $2,900 at the time of writing, as the Dencun upgrade approaches and transaction numbers on L2s climb up.

The Ethereum Cancun-Deneb (Dencun) Upgrade, scheduled for March 13, 2024, is a pivotal hard fork aimed at enhancing the network's scalability, security, and usability. This upgrade, incorporating key Ethereum Improvement Proposals (EIPs) such as EIP-4844 for proto-danksharding, is set to improve network efficiency and lower transaction costs. Building on the achievements of prior updates like the Shanghai upgrade, Dencun seeks to fortify the infrastructure for decentralized applications and elevate the Ethereum user experience.

At its heart, the Dencun Upgrade integrates advancements from the Cancun upgrade on the execution layer with those from the Deneb upgrade on the consensus layer, employing a dual approach to refine Ethereum's protocol rules and block validation procedures. The inclusion of various Ethereum Improvement Proposals (EIPs), especially Proto-Danksharding, is geared towards enhancing scalability from different dimensions.

Additionally, the upgrade will introduce a series of other EIPs, including EIP-4788, EIP-6780, and EIP-5656. While this article will concentrate on the most crucial proposal, EIP 4844: Protodanksharding, it will also touch upon three staking and validator-centric improvements within the Dencun Upgrade: EIP-7044, EIP-7045, and EIP-7514.

EIP 7044: Perpetually Valid Signed Voluntary Exits

The introduction of EIP-7044 marks a significant advancement: exit messages will have indefinite validity, removing the need for continual updates and ensuring a smoother withdrawal process. This EIP specifically targets the challenge posed by the limited lifespan of signed voluntary exit messages, simplifying the staking landscape, especially in cases where the staking operators and fund owners are not the same.

TL;DR: EIP-7044 makes it easier to withdraw staked funds by ensuring that exit requests don't expire. This removes the hassle of having to update these requests regularly, especially helpful when the staking operators and fund owners are different.

EIP 7045: Increase max attestation inclusion slot

EIP-7045 modifies the timeline for attestations, extending the inclusion period from one rolling epoch to two fixed epochs. This adjustment gives validators additional time to incorporate their attestations into a block, thereby enhancing the security and stability of Ethereum's Proof of Stake (PoS) consensus mechanism. The expansion of maximum attestation slots contributes to quicker block confirmations and bolsters the consensus mechanism's resistance to short-term censorship attempts.

TL;DR: EIP-7045 changes how long validators have to get their approvals into a block, extending it from one flexible time period to two set time periods. This extra time helps make Ethereum's system for confirming transactions more secure and stable, speeds up the process of confirming blocks, and makes it harder for anyone to temporarily block or censor transactions.

EIP-7514: Add max epoch churn limit

EIP-7514 proposes to change how fast new validators can join the Ethereum network. Instead of the current system where the number of new validators can grow quickly (exponentially) because the amount of new validators accepted also grows, this proposal suggests a steady (linear) increase by setting a limit of 8 new validators per epoch (~6.4 minutes). This means no matter how many people want to become validators and how big the active set grows, only 8 will be able to join in each epoch. This approach aims to make the network more manageable, especially when a lot of people are waiting to stake their ETH. It helps prevent the network from getting overloaded and keeps everything running smoothly.

TL;DR: EIP-7514 plans to limit the number of new validators joining the Ethereum network to 8 every 6.4 minutes. This change aims to control growth and prevent the system from becoming overloaded, ensuring it runs smoothly even when many people want to stake their ETH.

EIP-4844, known as Proto-Danksharding, is a key update to Ethereum that introduces a new type of transaction called "blobs", for better data storage efficiency. This allows for more cost-effective data posting to the Ethereum mainnet by Rollup sequencers, without overloading the network, due to the controlled size and quantity of blobs in each block. The innovative aspect is the temporary storage of blob data in Ethereum's consensus layer, not its execution layer, which boosts scalability while keeping the network decentralized. Proto-danksharding sets the stage for further scalability enhancements, such as full Danksharding, by improving gas consumption and network resource management.

Proto-danksharding allows these rollups to employ data blobs for posting grouped transactions more affordably, greatly decreasing operational expenses and enhancing scalability.

The Dencun upgrade is set to significantly enhance Ethereum's appeal, making it more attractive for developers, builders, and investors, by boosting transaction efficiency and cutting costs.

At Chorus One, we've been diligently preparing for this upgrade, ensuring our clients and software are updated in a timely manner to prevent any impact on our users. Our proactive approach underscores our dedication to facilitating a smooth transition and maintaining strong staking support after the upgrade.

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Summary

EigenLayer’s mainnet is just around the corner and has been the talk of town lately. In a nutshell, EigenLayer is a new primitive that democratizes access to restaked rewards by aggregating and propagating cryptoeconomic security to a broad suite of applications being built on top of Ethereum.

Chorus One has long been immersed in the ecosystem, and has now proudly launched our newest solution to further simplify ETH staking - OPUS Pool. This new product allows any user to easily stake ETH, mint osETH, and integrate with EigenLayer seamlessly, streamlining the process for both new and existing customers.

Additionally, users have the extra benefit of depositing not only osETH, but any other accepted liquid staking tokens (currently, stETH, cbETH, and rETH) into EigenLayer - making it significantly easier for anyone to participate in ETH restaking and earn additional rewards.

Kick-start your ETH staking journey with Chorus One! Enter the OPUS Pool here.

In this article, we break down the fundamentals of EigenLayer and Restaking, key benefits and risks, Chorus One’s involvement in the ecosystem, and how investors and institutions can restake seamlessly using the OPUS Pool. Dive in!

Restaking in the context of Ethereum, as defined by Vitalik Buterin, is a process that allows stakers to extend their staked assets' utility beyond the Ethereum network. This concept, integral to Ethereum's Proof of Stake (PoS) framework, enables staked ETH to not only support Ethereum's network but also to bolster the security and trust systems of other blockchain platforms.

Through restaking, assets that would otherwise be dormant within Ethereum gain a new functionality, serving multiple networks simultaneously and offering stakers the opportunity to earn additional rewards from various sources. Ethereum's dense network of validators and the spread of staked assets contribute to its robust security, making it an ideal candidate for restaking.

EigenLayer has pioneered this primitive by integrating smart contracts into Ethereum, facilitating restaking and expanding the possibilities for asset utilization.

It creates a market-driven ecosystem where security is pooled and governed by supply and demand. Users can opt-in to EigenLayer smart contracts to restake their $ETH or LST(liquid staking token) and extend cryptoeconomic security to additional applications on the network. Part of EigenLayer’s potential, therefore, lies in its ability to aggregate and extend cryptoeconomic security through restaking and to validate new applications being built on top of Ethereum or beyond.

Actively Validated Services (AVS), essentially new projects or applications building on Ethereum, can tap into this pool, consuming security based on their needs while validators opt-in at their discretion, weighing risks and rewards. This system negates the need for AVSs to establish their own validator networks, instead allowing them to utilize Ethereum’s existing security infrastructure.

EigenLayer not only enhances capital efficiency by enabling staked tokens to be used across multiple protocols but also simplifies the process. Ultimately, it aims to unify cryptoeconomic security within a single ecosystem, reducing the fragmentation of security across protocols and increasing trust through a larger validator network.

There are two key advantages:

Firstly, stakers can earn or stand to earn additional rewards through restaking by taking on more responsibilities.

Secondly, emerging protocols benefit from the robust security provided by Ethereum's established pool of validators. This creates a mutually beneficial relationship between Ethereum's foundational layer and other blockchain protocols, enhancing the overall ecosystem.

Before taking a deeper look into the ecosystem and how users may get involved, let’s take a look at the fundamental ideas introduced by EigenLayer:

By combining these ideas, EigenLayer serves as an open marketplace where AVSs can rent pooled security provided by Ethereum validators.

While Restaking with EigenLayer presents numerous benefits, there are certain challenges and risks.

There are primarily two categories of risks associated with restaking with EigenLayer:

(1) many operators may collude to attack a set of AVSs simultaneously

With only a subset of operators choosing to restake in specific AVSs, this selective participation opens the door to potential collusion among operators, who might conspire to compromise the system for financial gain, particularly if they are restaking across multiple AVSs with substantial total locked values.

(2) the AVSs built on EigenLayer may have unintended slashing vulnerabilities — this is the risk of honest nodes getting slashed.

The risk of unintended slashing is significant, especially in the early stages of AVS deployment before thorough battle-testing. Vulnerabilities, such as programming bugs, could trigger slashing and result in losses for honest participants. To mitigate these risks, EigenLayer proposes rigorous security audits of AVS codebases and a governance layer capable of vetoing unjust slashing decisions.

We’ll cover the potential risks and management strategies in more depth in an upcoming article in this EigenLayer series, stay tuned!

Chorus One has been actively engaged in the EigenLayer ecosystem since its early days, evolving alongside it, and has recently integrated EigenLayer restaking into our latest product, OPUS Pool.

OPUS Pool is our latest addition to the OPUS product suite enabling anyone to stake any amount of ETH with Chorus One. Not only that, users also have the extra benefit of depositing any other accepted liquid staking tokens (including osETH, stETH, cbETH, and rETH) into EigenLayer in one go!

Essentially, we have opened up an avenue for anyone (OPUS and non-OPUS users) to participate in restaking as easily as possible.

For a step-by-step guide on how to get started with restaking with Chorus One, visit our comprehensive guide.

Additionally, we have been greatly involved within the ecosystem in a multitude of ways:

…. And more!

EigenLayer revolutionizes staked asset utilization, enhancing validator rewards and strengthening protocol economies. It catalyzes the creation of innovative protocols and services, enriching the Ethereum ecosystem. This advancement fosters Ethereum's growth, making it more attractive to institutional investors by allowing a single staking mechanism to secure diverse protocols, improving resource use and network efficiency, and broadening the stakeholder base.

Why should you choose Chorus One for Restaking?

To start your ETH staking journey with Chorus One, head to OPUS Pool!

Check out our step-by-step guide for a comprehensive overview of how you can get started.

For any questions, information, or suggestions, please reach out to us at staking@chorus.one, and we’ll be in touch!

A step-by-step guide to the OPUS Pool for ETH Staking

MEV Max - Introducing Chorus One’s vault on StakeWise V3

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

In an era of rapid technological evolution, Soarchain emerges as a vanguard in the automotive industry, redefining the landscape of vehicle-based applications and services. By harnessing the power of blockchain and hardware, Soarchain simplifies the complexities of vehicular connectivity, offering a platform for applications ranging from real-time insurance adjustments to AI-driven diagnostics and safety enhancements. With its Layer-1 Decentralized Physical Infrastructure Network (DePIN) built on the Cosmos SDK, Soarchain is set to transform the mobility sector, offering a more inclusive, transparent, and scalable alternative to the proprietary networks dominating today's market.

In this article, we explore how Soarchain unlocks dePIN’s full potential.

Quick pit stop to share that we at Chorus One are on the journey with Soarchain as proud investors.

However, please note that our support and enthusiasm for this venture should not be interpreted as financial advice. While we're keen to explore the blockchain landscape with Soarchain, we advise you to make investment decisions based on your own research and judgment. Consider us as companions sharing insights, not as guides for your financial journey.

In a gist, DePIN refers to decentralized networks that employ the use of hardware to enhance data collection for specific use cases. For a wider view of the entire ecosystem, please refer to Mesari’s 2023 report.

Traditional Verification Methods and Conflicts of Interest:

Unwanted Permission Layers and Security Vulnerabilities:

Scalability Constraints and Oracle Problem:

Specific Network Challenges:

Verification in DePIN Projects:

Incentive Challenges:

Soarchain tackles these through decentralized sequencers, governance frameworks, and a layered approach to network architecture, enhancing scalability and privacy.

Soarchain introduces a robust architecture for onboarding new factory manufacturers and hardware providers in a secure and scalable manner.

Manufacturers can generate a Certificate Signing Request (CSR) using the on-chain Root Certificate through governance proposals. Soarchain aims to incorporate tier-1 manufacturers. This specifically targets those incorporating secure elements in their Electronic Control Units (ECUs) or modules, a growing trend for enhanced security in automotive electronics. This integration will unlock new possibilities on Soarchain, like supply chain management, manufacturing process optimization, and trustless Over-the-Air updates for ECU firmware/software, a long standing costly challenge.

The system allows factories to submit governance proposals for inclusion, followed by proposals to issue a certain number of certificates. A key concern is that issuing non-time-bound or non-quantity-bound certificates grants manufacturers indefinite production rights. This could lead to a lack of accountability for their manufacturing processes and the products they produce. This innovative approach leverages Cosmos SDK and democratizes the onboarding of new manufacturers. It ensures that every level of the manufacturing and device integration process is secure, flexible, transparent and scalable.

Scaling with the Runner Network - The Celestia of DePIN

To address scalability, Soarchain implements a layer-2 solution with runner nodes that handle the bulk of data processing. This significantly reduces the load on the main blockchain and enhances the network's capacity to handle large data transactions. Runner nodes in Soarchain parallel the function of sequencers in the Celestia network. They manage data flow, gather public keys, create Merkle trees, and submit these summaries to the blockchain. From the Layer 1 perspective, the addition of thousands of vehicles and hundreds of thousands of new messages translates to only a moderate increase in network transactions.

Soarchain employs a Verifiable Random Function (VRF) within its core layer-1 virtual machine to dynamically select a consensus group from the pool of runners, preventing data validation centralization and potential collusion, operating like a decentralized sequencer. Runners in the consensus group are tasked with receiving, ordering, and verifying messages from vehicles, using these to create Merkle trees. They then generate and submit claims about these trees to validate their honesty and correctness. The system involves a distributed key generation process (Shamir Secret sharing algorithm) and threshold public key encryption to ensure that the content each runner submits is identical, maintaining the integrity of the verification process.

Users can operate a 'runner' via the Motus Connect and Drive mobile app. This setup allows users to earn extra network rewards. Runners are akin to Celestia's light clients but with an added responsibility: they sequence messages and verify their authenticity, ensuring the content is original, unaltered, and plausible. Similarly, more runners in Soarchain increase the number of supported vehicles, thereby expanding the network's message broadcasting capacity (as long as a certain percentage of full / validator nodes operate as runners).

Runners are also required to delegate a minimum amount of tokens to a validator. This serves two purposes:

Just like that, Soarchain presents the first ever mobile / app based shared sequencer to operate light clients.

Soarchain has integrated zk-SNARKs, particularly through the Groth16 scheme, to ensure robust data verification while maintaining confidentiality. This technology allows vehicles to generate cryptographic proofs of data authenticity and integrity without revealing the underlying data, thereby preserving privacy.

The use of zk-SNARKs, particularly through the Groth16 scheme, allows for efficient management of multiple proofs for similar types of PID data, crucial in Soarchain's network. Soarchain employs a unique method to verify the plausibility of PIDs (Parameter IDs) through two approaches: individual analysis of each PID and joint analysis of PIDs with known high correlations. Each Performance Indicator Data (PID), like fuel pressure or engine temperature, is validated meticulously, ensuring the accuracy and reliability of data transmitted via distributed MQTT brokers. This process ensures user privacy, as it doesn't require decrypting plaintext data on the public blockchain. Instead, plausibility checks are conducted while preserving privacy. This is made possible through specially designed arithmetic circuits, verified using zero-knowledge methods, ensuring that no sensitive data is exposed during the verification process.

The oracle problem, particularly in the context of Soarchain, refers to the challenge blockchains face in accurately interacting with external, real-world data. For Soarchain, this data is physical, real-time mobility information generated by sensors, cameras, and actuators on vehicles and road users. The key issue is ensuring the data's authenticity and that the data sources are honest. To address this, Soarchain uses hardware equipped with a secure element, ensuring that a) the hardware runs the intended firmware, preserving the operational integrity, and b) private keys corresponding to public keys and certificates are securely stored, safeguarding the security, integrity, and authenticity of the data.

Once these pre-verification checks are completed, the data is transformed into "messages" akin to transactions and sent to Soarchain's verification layer. This layer constructs Merkle trees using these messages and generates a proof once a certain number of messages are aggregated. The proof is then submitted to the chain, and the metadata of the data is immutably recorded on the blockchain. This process enables any entity on the chain to interact with a reference to the proven and verified data originating from real-life sources.

To overcome the oracle problem's scalability constraints and complexities, Soarchain combines decentralized oracle systems with hardware-accelerated and proof-based mechanisms. While centralized oracle solutions pose a risk of single-point failure and require significant trust, decentralized oracles, though more secure, often lack a hardware-accelerated, proof-based system. Soarchain's runner architecture not only serves as an incentivized, trust-minimized oracle network, but it also acts as a scaling layer. This allows for the aggregation and proof of pre-verified data messages without needing to submit each message in full to the blockchain. This method significantly reduces the burden on the blockchain while maintaining the integrity and trustworthiness of the data being processed.

In conclusion, Soarchain stands at the forefront of revolutionizing decentralized mobility and related applications. Its robust Layer 1 blockchain technology enables a myriad of real-world applications, from decentralized ride-sharing platforms, offering a more equitable and transparent system, to smart parking solutions that ensure secure, fraud-resistant transactions. Additionally, Soarchain plays a pivotal role in the coordination of autonomous vehicles, promoting safety and efficiency through real-time communication and decentralized consensus.

Soarchain represents a significant leap forward in the world of decentralized networks. Its innovative governance framework, the integration of zk-SNARKs for data verification, and the unique approach of using runner nodes and a decentralized sequencer collectively forge a path towards a more secure, scalable, and trustable digital future. With these technologies, Soarchain is not just solving the present challenges of dePINs but also paving the way for the untapped potential of hardware based decentralized networks.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Throughout 2023, Chorus One maintained its standing as one of the select few node operators to consistently deliver in-depth research reports, wherein our dedicated in-house research team delves into the latest developments in the crypto and staking world.

Edition #4 of our 2023 Reflections series recaps Chorus One’s significant research efforts in 2023. Dive in!

This year, Chorus One introduced a major research effort, fueled by a grant from dYdX, that examines the implications of Maximum Extractable Value (MEV) within the context of dYdX v4 from a validator's perspective.

This comprehensive analysis presents the first-ever exploration of mitigating negative MEV externalities in a fully decentralized, validator-driven order book.

Additionally, it delves into the uncharted territory of cross-domain arbitrage involving a fully decentralized in-validator order book and other venues.

Dive in: https://chorus.one/reports-research/mev-on-the-dydx-v4-chain#

We present a comprehensive analysis of the implications of artificial latency in the Proposer-Builder-Separation framework on the Ethereum network. Focusing on the MEV-Boost auction system, we analyze how strategic latency manipulation affects Maximum Extractable Value yields and network integrity. Our findings reveal both increased profitability for node operators and significant systemic challenges, including heightened network inefficiencies and centralization risks. We empirically validate these insights with a pilot that Chorus One has been operating on Ethereum mainnet.

Dive in: https://chorus.one/reports-research/the-cost-of-artificial-latency-in-the-pbs-context

TL;DR: https://chorus.one/articles/timing-games-and-implications-on-mev-extraction

We published a whitepaper comparing key characteristics of Ethereum and Solana, which explores the block-building marketplace model, akin to the "flashbots-like model," and examines the challenges of adapting it to Solana.

Additionally, recognizing Solana's unique features, we also proposed an alternative to the block-building marketplace: the solana-mev client. This model enables decentralized extraction by validators through a modified Solana validator client, capable of handling MEV opportunities directly in the banking stage of the validator. Complementing the whitepaper, we also shared an open-source prototype implementation of this approach.

Dive in: https://chorus.one/reports-research/breaking-bots-an-alternative-way-to-capture-mev-on-solana

Every quarter, we publish an exclusive report on the events and trends that dominated the Proof-of-Stake world. Check out our Quarterly reports below, with a glimpse into the topics covered in each edition.

Titles covered:

Read it here: https://chorus.one/reports-research/quarterly-network-insights-q1-2023

Titles covered:

Read it here: https://chorus.one/reports-research/quarterly-network-insights-q2-2023

Titles covered:

Read it here: https://chorus.one/reports-research/quarterly-network-insights-q3-2023-2024

If you have any questions, would like to learn more, or get in touch with our research team, please reach out to us at research@chorus.one

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

Staking rewards generally derive from a combination of inflationary rewards, transaction fees, and MEV. We are certain that a complete understanding of the Ethereum PBS pipeline allows validators to extract more MEV through targeted infrastructure optimizations.

While adjacent topics have been discussed in literature (e.g. Schwarz-Schilling et al., 2023), Chorus One is the first node operator to successfully test out different optimization approaches on mainnet. We find that the most impactful improvements are contingent on comprehensive internal data, and have generally not been discussed in their specificity.

The goal of this article is to share the results of a recent pilot. We will follow-up with more detail in a later, comprehensive study, which we are co-authoring with one of the most recognizable and competent teams in the MEV space.The pilot makes use of several modifications which positively impact MEV extraction. The rest of the article will discuss one straightforward, illustrative example in more detail, and present the overall results of the pilot so far.

There are two components to APR optimization. Firstly, we should maximize the payoff of the blocks we propose, and secondly, we should minimize the likelihood of missing our chance to propose (i.e. missing our slot). The first of these is more complex and can be approached in several ways, including via latency games, and other infrastructure optimizations.The latter is more accessible, and primarily hinges on running a robust infrastructure setup with appropriate redundancy. However, relay selection also plays a role. Let’s dive in!

A basic illustrative adjustment: drop underperforming relays

The goal of this section is to give an example of a straightforward MEV-adjacent infrastructure adjustment that can positively impact validator APR by minimizing the probability of a missed slot. This modification is not central to our MEV strategy in terms of impact, but it is illustrative of the Ethereum MEV supply chain.

As per conventional wisdom, a validator is best off integrating with a large number of relays, as the mev-boost auction will yield the highest bid, i.e. there is no obvious downside to soliciting a maximum number of bids.

This is only half of the story. Let’s recall how validators and relays interact in more detail. First, the validator requests a block header from a relay, which then delivers the header corresponding to the most profitable block available to the relay. In parallel, the validator also solicits bids from all other relays it is integrated with. The mev-boost auction then determines the highest bid, the validator signs the header associated with this bid, and asks all relays to deliver the payload associated with this header.

The relay that is quickest to respond (typically the relay that delivered the original bid) then broadcasts the block and returns the associated payload to the proposer. This may be done with a delay versus previous implementations (i.e. at proposer’s slot t=0), as early distribution of the payload theoretically allows an unethical proposer to build an alternative block exploiting the transactions in the block received from the relay. This vulnerability has been outlined by the “low carb crusader”, and more details can be found in this post by Flashbot’s Robert McMiller.

The upshot is that in addition to transferring bids from builders, relays also carry responsibility for propagating the final signed block to the network. This is more pronounced now than previously, as the time available for this step has been decreased. Therefore, validators should favor relays that deliver payloads rapidly, or run an idiosyncratic risk of missing their slot, for relays that underperform.In practical terms, we find that relays can diverge significantly on delivery speed, and that for one relay in particular, a routine network disturbance could lead to a missed slot if the validator depends on it to deliver a given block.

The following graph shows the cumulative probability distribution for the maximum time at which a block becomes eligible within each slot, and each line represents a relay.This is a snapshot that is relative to a subset of our nodes over a limited period, and relay performance can vary over time, i.e. should be constantly and granularly monitored. Relays are currently a costly pro-bono good, and we appreciate providers subsidizing the network in this way.

In practical terms, for this particular cluster of nodes, running the relay color-coded light blue is a negative EV decision, i.e. it should be dropped. This is due to the consistent delay it exhibits in making blocks eligible, as compared to other relays.

Our current MEV pilot: A first look at the results

Our current MEV pilot combines straightforward adjustments, like the relay selection process illustrated above, with more significant and systematic infrastructure optimizations.

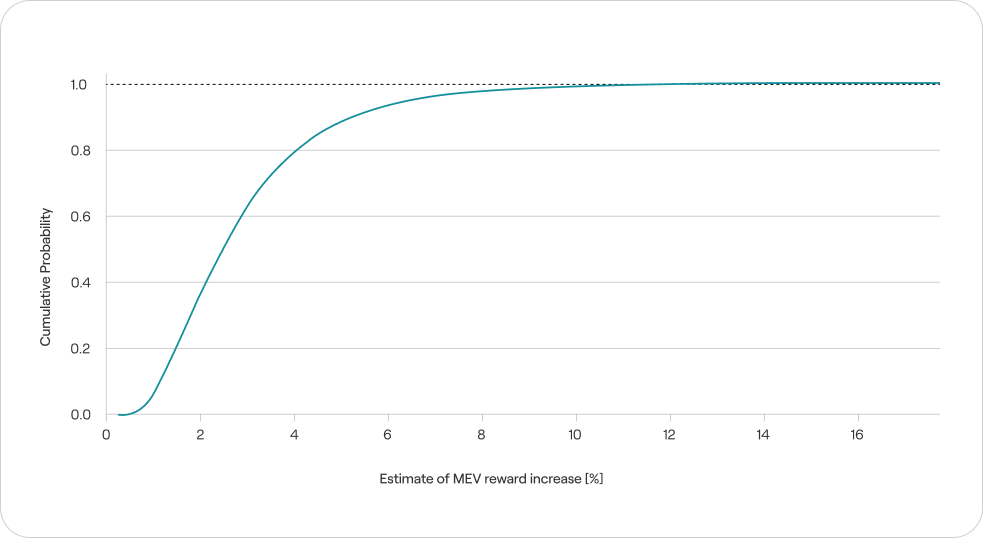

The below graphs are a first look at the results, and summarize performance over approximately a quarter.

As such, getting a grip on variance requires robust statistical processing. As MEV is tail-heavy (i.e. most profit is produced by rate opportunities), results can vary significantly over time, and capital invested. We are comparing the MEV payoff distribution of the pilot with the MEV payoff realized by a set of Lido nodes. On a per-block level, we find that our pilot has improved MEV rewards significantly:

This extends to the aggregate case - over our sample, the pilot has extracted higher rewards than a “vanilla” setup with a probability approaching 100%:

The upshot is that we feel highly confident that the infrastructure optimizations implemented in our pilot study aggregate out at an APR that is consistently higher than what a non-optimized setup typically achieves.We will elaborate further on specifics in a forthcoming study. If you are interested in learning more about our approach to MEV, please reach out to us anytime at research@chorus.one.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.