Our EigenLayer strategy is to onboard all the AVSs that have chances of being break-out winners, while filtering out the long tail of AVSs that introduce complexity and risk. With this combination, we aim to deliver the best risk-adjusted reward APY to users delegating their restaked assets to by Chorus One. The first section covers our thesis, the second our onboarding policy and the third our track record.

The EigenLayer ecosystem will have hundreds of AVSs and be the leading mechanism for Ethereum to scale and service billions of users.

We expect individual AVSs to follow a power law distribution in competency and success, similar to the patterns observed elsewhere in crypto. For Cosmos, an application-specific ecosystem similar to EigenLayer, this data-set shows 6 chains have over $1 billion circulating market cap, 16 are between $100 million and $1 billion, and 42 are under $100 million. Most Cosmos chains never achieve significant success, with market caps exceeding $100 million. The median chain barely gains traction and struggles for attention and impact. In the broader crypto market, there are ~14,000 tokens (from CoinGecko). The median token is illiquid. All the realized alpha in crypto lies in the outliers - the top 500 chains with market caps above $90 million and sufficient liquidity. AVSs will be similar - all the returns will exist in the top 20% of AVSs.

Not only are successful AVSs the exception, but there is major alpha in early participation in promising projects with no defined market value. Most AVS projects will spend significant time in a pre-launch phase where the mainnet service does not exist. Testnets are rolled out while the developers build functionality and product features. During this phase, there is no clarity on the economics of reward delivery of the AVS. There is also no market cap, token supply, or token price information to rely on. There are likely also caps on the number of operators that can be enrolled by the project developers for testing. Because of the lack of information and transparency in the market, the overall ecosystem of Node Operators (NO’s) and restakers cannot perfectly judge the project. Hence, outsized yields, can be produced. The EIGEN token delivers the best example of such an opportunity - it delivered returns to early restakers in the 30%-60% range, depending on when exactly the restakers participated and how trading markets stabilize.

It is possible (and a mistake) to onboard the entire long-tail of AVSs. Such an approach will radically boost infrastructure complexity and risk. Complexity and risk lead to the need to charge high commissions, thus reducing the risk-adjusted APY for restakers. Eventually, it accentuates slashing risk. Technical due diligence, that tests for originality and legitimacy of software work, as well as application of software development best practices has always been and continues to be the best method for filtering out the long tail, and narrowing focus on the break-out winners.

We will apply our infrastructure effort in a subset of chains that pass our strict filtering criteria. When multiple AVSs pass our filtering criteria concurrently, our internal prioritization will look at the positive signals from the projects.

Our filtering criteria focuses on evaluating the software engineering of projects. Our method for evaluation consists of 3 parts:

Our filtering criteria focuses not on the easily molded exteriors of the project - the website, the podcasts or the marketing - but rather on the hard to change signal-rich factors that usually accompany a winning project in crypto.

When multiple AVSs cross our filter and require prioritization, we will prioritize them depending on the following signals:

We’ve applied a similar framework for our onboardings across Cosmos and in our venture investments. Chorus One is the most successful validator venture investor counting early participation in Solana, Lido, Celestia, Dymension, Saga, Wormhole, GogoPool, Neutron and Osmosis. In addition, we have infrastructure certifications highlighting the care with which we operate the networks.

Cosmos is the best example of an alternative application specific eco-system similar to EigenLayer. Our selection process, applied over 6 years has consistently picked all the top 20 chains, except two. On Cosmos, we have the best track record on participating with the governance processes of application specific chains.

Our early experience in EigenLayer, which includes research on network wide risk and slashing cascades, reinforces our belief in our onboarding process. We’ve encountered AVSs with plagiarized code, closed source code, and AVSs with key management systems that would expose our entire EigenLayer setup (operator key) to attack. These experiences have made it impossible for us to follow an “onboard all AVSs” path.

As a restaker with Chorus One, you derive the following benefits with our approach:

We will never be the operator with the most number of AVSs onboarded. And that works because it is far more critical to be early supporters of the break-out successes. Here’s to finding the gems early!

Seamlessly restake with Chorus One using OPUS Pool: https://opus.chorus.one/pool/stake/

Here's a step-by-step guide to using OPUS Pool: https://chorus.one/articles/your-guide-to-opus-pool-stake-mint-oseth-and-restake-with-eigenlayer

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

The EigenLayer ecosystem has emerged as a crucial driver of innovation and expanding the capabilities of the Ethereum network. As a leading node operator, we have taken a strategic, Safety over Speed approach to identifying and onboarding some of the most exciting Actively Validated Services (AVSs) that are set to transform the industry.

Let's dive into the first batch of EigenLayer AVSs that Chorus One is registering:

1. EigenDA: Scaling Data Availability for Rollups [Onboarded]

At the heart of the scalability challenges faced by Ethereum lie the complexities of data availability. EigenDA aims to tackle this problem head-on by providing a secure and scalable data availability solution for optimistic and zero-knowledge (ZK) rollups. By leveraging the restaking primitive developed by EigenLabs, EigenDA empowers rollups to access lower transaction costs, higher throughput, and robust security across the EigenLayer ecosystem.

Why we onboarded EigenDA: As the first AVS to launch on the EigenLayer mainnet, and its impressive $1 billion in total value locked (TVL), we see immense potential in supporting EigenDA and positioning it as a preferred solution for leading Layer 2 ecosystems, including the OP Stack.

2. Brevis: Trustless Co-Processing for Data-Rich Applications [Onboarded]

Brevis belongs to a class of solutions that thrive within the EigenLayer ecosystem – co-processor networks. These specialized networks extend the functionality of a stack to handle computationally intensive tasks, such as verifying complex data points for decentralized applications (dApps).

Brevis tackles the challenge of "data-rich" use cases, where retrieving and validating on-chain data can be both time-consuming and costly. By leveraging a novel "propose-challenge" model, Brevis generates ZK proofs to ensure the accuracy of its results, empowering applications in DeFi, user-segment optimization, and beyond to operate in a truly trustless manner.

Why we onboarded Brevis: Our decision to onboard Brevis as its second AVS was driven by the project's open-source codebase and the alignment with the team's vision. As a modular and efficient solution, Brevis aligns perfectly with Chorus One's commitment to driving innovation and supporting the growth of the decentralized ecosystem.

3. Eoracle: Bringing Transparency and Security to Oracle Networks

One of the biggest hurdles in the crypto industry has been the "oracle problem" – the challenge of reliably and securely bringing real-world data onto blockchain networks. Eoracle aims to address this issue by creating an Ethereum-native oracle solution that leverages the decentralization, transparency, and security of the Ethereum network.

Why are we onboarding Eoracle: As the "Data Validator" AVS operated by Chorus One, Eoracle connects node operators to compute, validate, and publish off-chain data to dApps in a secure and trustless manner. By tapping into the Ethereum validator set through EigenLayer, Eoracle represents a crucial step towards building a more robust and reliable oracle infrastructure for the decentralized ecosystem.

4. Lagrange: Cryptographically secured proofs for the Multichain Future

Inspired by Ethereum’s Sync Committee, Lagrange’s State Committee seeks to provide a robust, scalable, and shared security solution for cross-chain interoperability. This works by enabling multiple protocols to derive security from a shared security zone made up of a single, dynamic set of Ethereum nodes. Operators can deploy the Lagrange State Committees in combination with restaking through EigenLayer, to address the challenges with current approaches to cross-chain interoperability.

Why we are onboarding Lagrange: As the first zero knowledge AVS on Eigenlayer, we are excited to work with an innovative solution like Lagrange. With 15+ committed professional operators and over $2 billion in pledged security by leading LRTs, we feel confident in supporting Lagrange in addressing the security question in cross-chain interoperability.

5. AltLayer: Bridging the Rollup Ecosystem

AltLayer offers two key services that are highly relevant to the Ethereum ecosystem. The first is their Rollup-as-a-Service (RaaS) solution, which enables the fast and customized deployment of rollups. The second, and more pertinent to Chorus One, is their "Restaked Rollups" – a vertically integrated suite of three AVSs that leverage EigenLayer's shared security to support decentralized rollups.

Why are we onboarding AltLayer: AltLayer's Restaked Rollup solution addresses key challenges facing decentralized rollups, such as the need for a decentralized sequencer (SQUAD), a robust verifier (VITAL), and fast finality (MACH). By onboarding this comprehensive suite of AVSs, starting with their MACH AVS in this iteration, we aim to provide critical infrastructure and support to the broader rollup ecosystem, accelerating the growth and adoption of scalable decentralized applications.

6. Witness Chain: Incentivizing Fraud Proofs for Optimistic Rollups

Optimistic rollups offer a promising path to Ethereum scalability, but their security properties have been limited by the lack of clear incentives for validators to diligently search for and submit fraud proofs. Witness Chain addresses this challenge with its Watchtower protocol – a programmable, trustless, and decentralized service that uses a novel "proof of diligence" mechanism to incentivize validators to support optimistic rollups.

Why are we onboarding Witness Chain: By onboarding Witness Chain as an AVS, we aim to continue our ongoing commitment to strengthening the security and decentralization of the L2 ecosystem, which is a crucial component of Ethereum's scalability roadmap. As optimistic rollups continue to gain traction, Witness Chain's services will play a vital role in ensuring the long-term viability and trust in these scaling solutions.

Stay tuned for Part 2 of this series, where we'll explore the additional exciting AVSs that Chorus One is onboarding to the EigenLayer network, further expanding the potential of the EigenLayer and Restaking ecosystem.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

We are thrilled to share the latest update from the EigenLayer ecosystem – a highly anticipated upgrade that promises to provide stakers with greater control and flexibility over their staked assets. Effective today, April 9th, the EigenLayer mainnet launch unlocks a suite of new features and functionalities for both stakers and node operators.

EigenLayer M2 builds upon the existing M1 contracts that have been operational on the Ethereum mainnet. This major upgrade introduces a crucial new capability: the ability for users to delegate their restaked Ethereum (ETH) or liquid staking tokens (LSTs) to the node operator of their choice.

And as one of the leading node operators, we’re thrilled to announce that users can now delegate their restaked Ethereum (ETH) and Liquid Staking Tokens (LSTs) to Chorus One!

Delegating to Chorus One is a seamless and secure experience. Users can easily delegate to Chorus one via any of the following options:

OPUS Pool is designed to make the restaking process effortless for our users. Here's a quick guide on how to delegate your assets through the OPUS Pool:

You can find the detailed, step-by-step guide for OPUS Pool here: https://chorus.one/articles/your-guide-to-opus-pool-stake-mint-oseth-and-restake-with-eigenlayer

Note: Restaking LSTs with EigenLayer is currently on hold and will resume once the deposit cap is raised. In the meantime, you are welcome to use OPUS Pool to stake any amount of ETH, mint osETH, and delegate your existing restaked LSTs.

.png)

Alternatively, you can directly delegate your assets to Chorus One via the EigenLayer dashboard. Here's how it works:

By choosing either OPUS Pool or Chorus One’s operator profile on the EigenLayer dashboard, you can seamlessly delegate your assets to Chorus One and benefit from our tailored approach, enhanced MEV rewards, and top-tier security measures.

Please Note: The upgrade doesn't yet allow Operators to earn yield for services provided to an AVS or to be at risk of slashing for Operator misbehaviors.

At the heart of the M2 upgrade is the introduction of delegation capabilities, empowering stakers to choose the node operator they wish to delegate their assets to. Specifically, the M2 contracts will enable users to deposit their Ethereum (ETH) or liquid staking tokens (LSTs) into EigenLayer through the StrategyManager (for LSTs) or the EigenPodManager (for beacon chain ETH). Additionally, stakers will now be able to withdraw their assets via the DelegationManager, regardless of the asset type.

For node operators, the M2 upgrade introduces the ability to opt-in to providing services for Actively Validator Services (AVSs) using the respective AVS's middleware contracts. However, the current iteration of the M2 contracts does not yet enable node operators to earn yield for the services they provide to AVSs or expose them to the risk of slashing for any potential misbehaviors.

In contrast to node operators who may prioritize onboarding as many AVSs as possible, Chorus One has adopted a more strategic and selective approach. Security is of paramount importance to us, and we meticulously vet each AVS before providing infrastructure support.

Our dedicated team thoroughly assesses the technical architecture and risk profile of every AVS under consideration. We leave no stone unturned, carefully evaluating factors such as the robustness of their systems, the soundness of their security protocols, and their overall risk appetite. Only those AVSs that meet our stringent criteria are granted access to our staking infrastructure.

This selective approach ensures that our users can have the utmost confidence in the management of their assets. By entrusting their stakes to Chorus One, our customers can rest assured that their funds are being handled with the highest levels of diligence and care, safeguarded by our rigorous vetting process.

To learn more about Chorus One's tailored approach to restaking, we encourage you to reach out to our team at staking@chorus.one. Our team will be happy to answer any questions you might have.

Ready to get started? Visit OPUS Pool and follow our detailed guide to easily delegate your assets to Chorus One.

The technical details of the M2 upgrade can be found in the official EigenLayer documentation, available at https://github.com/Layr-Labs/eigenlayer-contracts/tree/dev/docs. As the EigenLayer ecosystem continues to evolve, this latest milestone towards Mainnet promises to empower stakers and node operators alike, ushering in a new era of flexibility and control.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally, operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures. We are a team of over 50 passionate individuals spread throughout the globe who believe in the transformative power of blockchain technology.

Welcome back to the another edition of the (Re)staking Synopsis, your go-to source for the latest in Ethereum staking, presented by Chorus One.

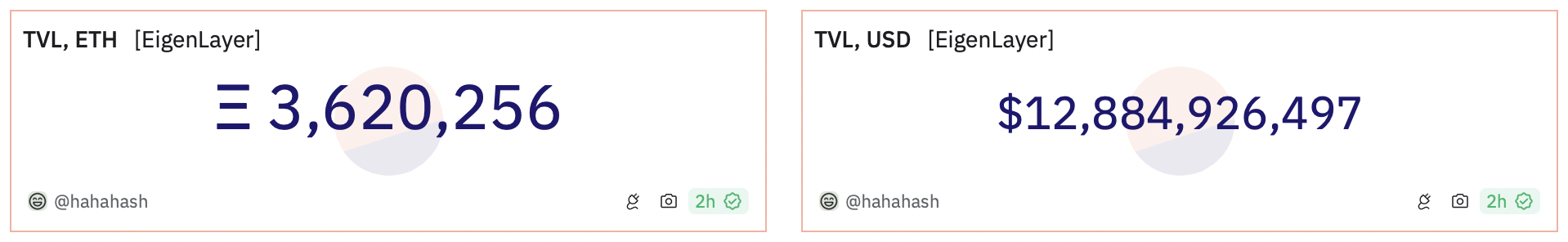

Cutting right to the chase: EigenLayer now holds the second spot in Total Value Locked (TVL) for a protocol, boasting over $12.8 billion USD (~3.6 million ETH) restaked. Impressively, nearly 2 million ETH has been natively restaked via EigenPods, marking a significant surge in restaking activity.

Additionally, the EigenLayer and EigenDA Holesky Testnet is live and thriving, with a staggering total of 157,433.0897 ETH already restaked! After a seamless testing phase on Goerli, we're thrilled to support this new phase as we progress towards Mainnet operations.

With a meticulously crafted AVS strategy, we prioritize the safety of the funds delegated to Chorus One. Learn more about restaking with Chorus One: https://forum.eigenlayer.xyz/t/operators-mainnet-campaign/12828/145?u=chorusone

Without any further ado, let’s dive in.

(Source: Dune Analytics)

OPUS Dedicated enables you to set up dedicated ETH validators, and directly restake your staked ETH with EigenLayer in a few clicks.

Note: At present, you can only deposit your staked ETH into EigenLayer; the option to delegate to Chorus One will be possible upon the EigenLayer Mainnet.

We will notify you once the delegation feature on EigenLayer becomes operational, indicating that it's time to delegate your restaked ETH. At that point, you will be able to delegate to Chorus One with just a few clicks.

How to restake ETH with EigenLayer

OPUS Pool enables you to stake any amount of ETH, mint osETH, and restake a variety of LST’s including osETH, cbETH, stETH, and more directly with EigenLayer in a just a few clicks.

Note: Restaking LSTs with EigenLayer is currently on hold and will resume once the deposit cap is raised. In the meantime, you are welcome to use OPUS Pool to stake any amount of ETH and mint osETH.

Visit OPUS Pool

How to Stake ETH and mint osETH

Read it here.

MEV-Boost targets the highest bid for Ethereum block space. However, a glitch arises when blocks include withdrawals, distorting the MEV valuation and making some bids appear more valuable than they really are, leading to losses for proposers.

Beyond individual losses, this issue has wider implications for the Ethereum ecosystem, inflating proposers' profits, cutting down overall transactions and gas usage, and consequently, decreasing ETH burning.

Our research team analysed the full impact of this bug, originally published on ETHResearch.

We explore how Ethereum's resilience is shaped by client diversity, offering an in-depth analysis of two of its most prominent Consensus Layer (CL) clients: Lighthouse and Teku.

Read it here.

If you’re interested in staking/restaking with Chorus One, or learning more, simply reach out to us at info@chorus.one and we’ll be happy to get back to you!

Additionally, if you’d like us to share further resources on any topic, please let us know!

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

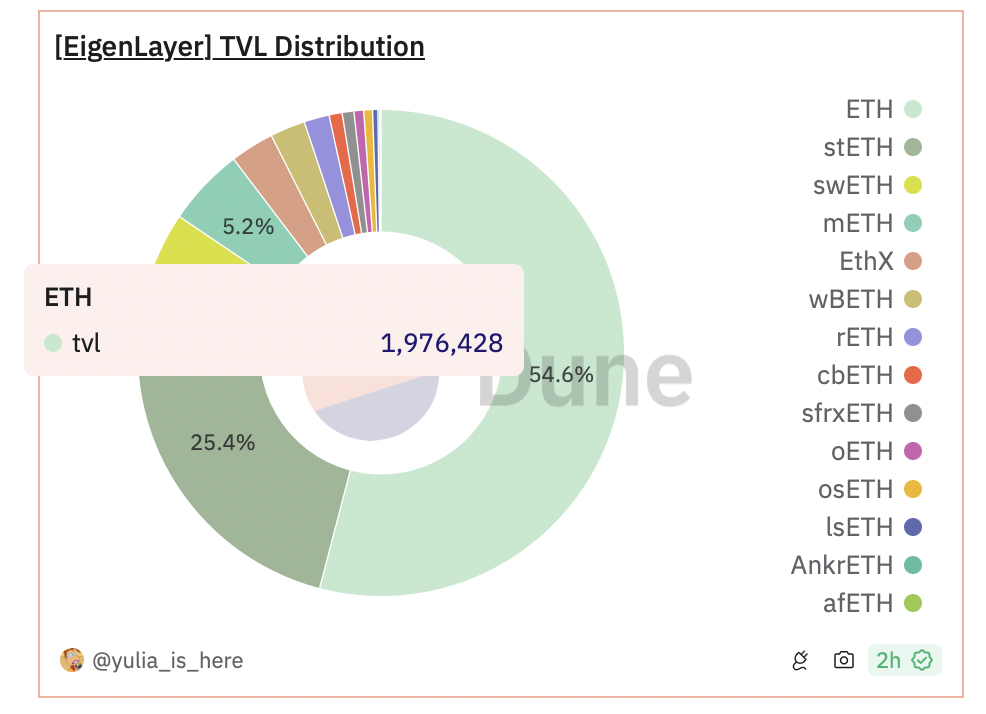

After what might have been the most anticipated launch so far, we're thrilled to be part of the continued innovation of blockchain technology by championing Dymension, as they work to pioneer the 'Internet of RollApps' with their unique modular features. Chorus One runs a public validator node and has also invested in Dymension through Chorus Ventures.

Dymension makes it easy for anyone to create and deploy their own blockchain, while providing its users the infrastructure and flexibility to scale and compete with other modern-day blockchain implementations.

In this guide, we'll cover what Dymension is and how it's pushing the boundaries of blockchain capabilities.

Unlike traditional blockchains that integrate data availability, consensus, settlement, and execution into a single layer, Dymension adopts a modular approach. This innovative method allows delegating one or more of these components to external chains, significantly enhancing performance, scalability, and efficiency.

Dymension aims to improve upon the current reliance on shared bandwidth systems used by many popular blockchains by using a multi-layer blockchain protocol. Consisting of a network of modular blockchains, known as "RollApps", these blockchains are powered by the Dymension Hub which is responsible for both consensus and settlement.

While initially the Dymension team will oversee RollApp approvals, the network aims to evolve into a permissionless ecosystem with the ultimate goal of serving as a decentralization router that connects RollApps to the crypto economy. In the long run, this will allow Dymension to be a "Internet Service Provider" for crypto and blockchain technologies.

To further detail its architecture, Dymension utilizes the Cosmos SDK for interoperability across blockchains, enabling RollApps to efficiently communicate and transact. The use of Tendermint Core for consensus ensures high security and fast transactions across the network. This technical foundation allows Dymension to support a wide range of applications, from finance to gaming, by providing developers with the tools to create highly scalable and customizable solutions.

As Dymension evolves, its architecture is designed to support a growing ecosystem of decentralized applications, ultimately facilitating a seamless connection between users and blockchain services on a global scale.

Dymension's unique proposition lies in its sophisticated modular architecture, designed to decentralize and optimize the components of blockchain functionality. By enabling external chains to handle aspects like data availability, consensus, and execution separately, it aims to not only significantly boost performance but also provide improved scalability and efficiency for all.

Here's how the Dymension team explains the ecosystem:

Dymension is similar to a full-stack web application where users interact with RollApps (front-end), Dymension (back-end) acts as the coordinator for the ecosystem, and the data availability networks (database) provide a place to publicize data.

Using the Cosmos SDK, Dymension incorporates a staking mechanism that enables participants to stake or unstake tokens with validators. This feature is central to maintaining the security and integrity of the network, allowing stakeholders to contribute to the ecosystem actively.

To kick off Genesis Rolldrop Season 1, Dymension is working to incentivize its users and builders by providing a significant allocation of tokens to pay tribute to three verticals within crypto, culture, money, and tech.

The tokenomics ($DYM) as of Feb 6th is as follows:

Total Supply: 1,000,000,000

Chorus One Valoper address: dymvaloper1ema6flggqeakw3795cawttxfjspa48l4x0e2mh

The Inter-Blockchain Communication Protocol is an important aspect of Dymension. IBC is a battle-tested bridging protocol that allows secure communication between different chains. RollApps connect to the IBC economy via Dymension Hub, similar to how a server connects to the internet via an internet service provider.

Dymension is working to reduce the reliance on centralized and commonly used multi-sig bridges prevalent in Ethereum and L2 ecosystems with IBC-connected rollups. By utilizing IBC for rollups, Dymension validates that all funds deposited into a RollApp are as secure as the Dymension Hub itself.

We firmly believe Dymension stands at the forefront of the next generation of blockchain technology, with its modular architecture promising to improve upon scalability and efficiency challenges faced by traditional blockchains. As supporters and collaborators, we continue to advise the team to best position themselves for a successful mainnet launch and beyond.

We are excited about the potential of Dymension to revolutionize the blockchain ecosystem, reinforcing our commitment to innovation and the growth of blockchain technology.

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks, including Ethereum, Cosmos, Solana, Avalanche, and Near, amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

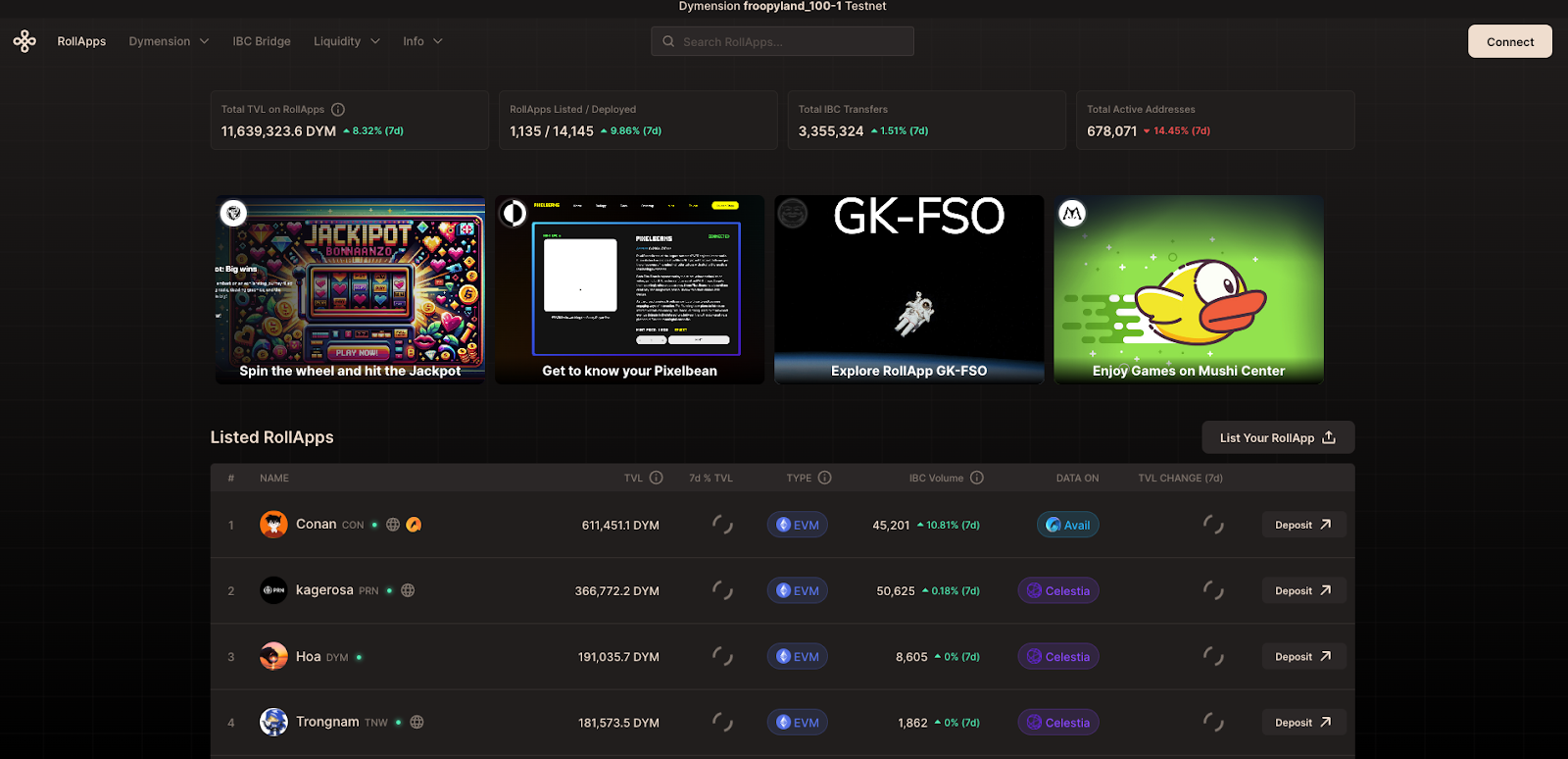

We’re thrilled to announce the launch of Chorus One's newest offering: the OPUS Pool. Until recently, a minimum threshold of 32 ETH was required for users to stake ETH on OPUS. But not anymore! Going forth, users may stake any amount of ETH directly via the OPUS Pool, mint osETH, and deposit into EigenLayer in one go.

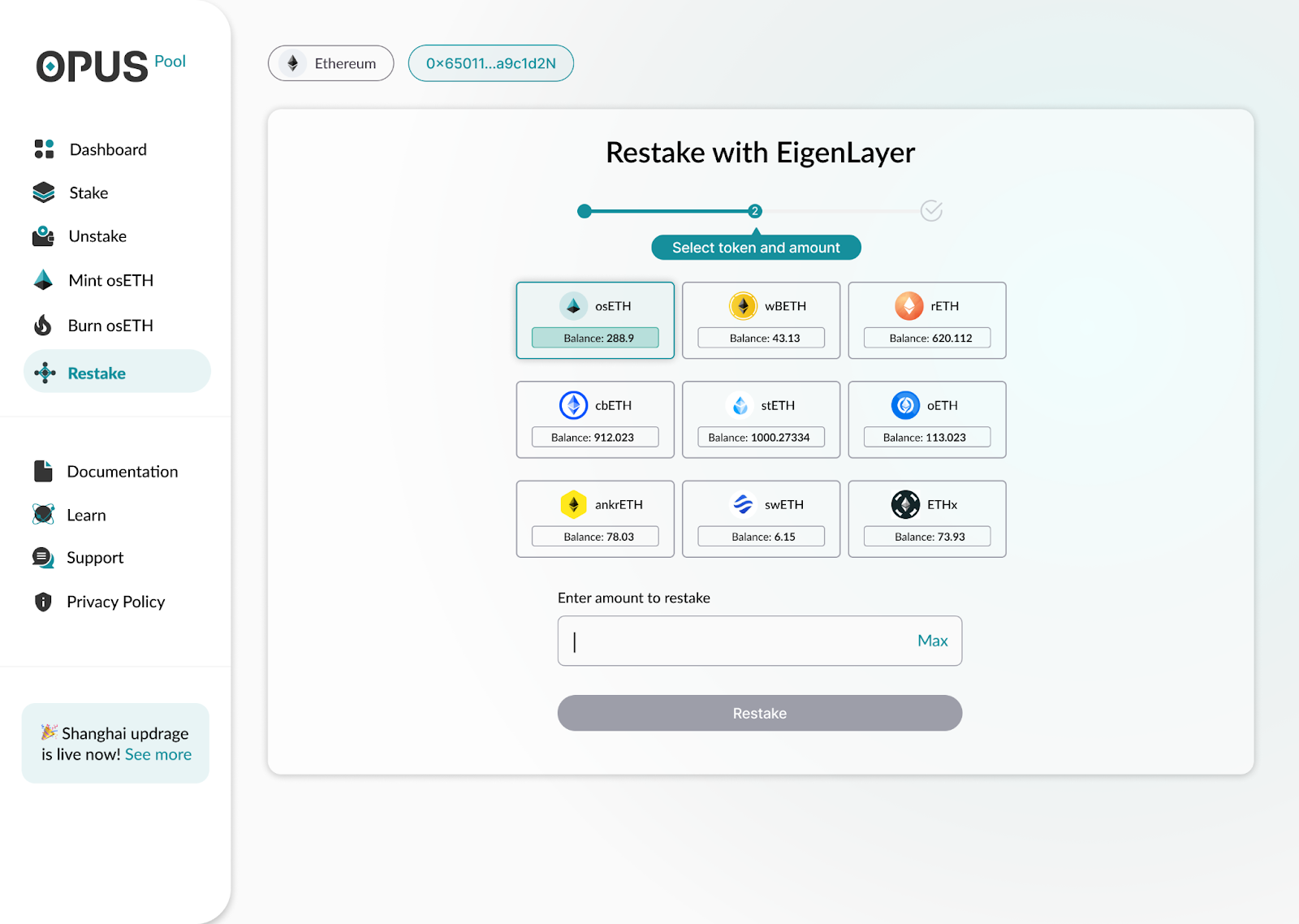

Users have the extra benefit of depositing not only osETH, but any other accepted liquid staking tokens (currently, wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx) into EigenLayer through the OPUS Pool!

Additionally, Institutional clients can leverage the OPUS SDK to integrate ETH staking into their offerings, providing their customers with all the benefits of the OPUS Pool seamlessly.

Start using OPUS Pool to stake ETH. Visit https://opus.chorus.one/pool/stake/

In this article, we’ll dive into why we launched the OPUS Pool, its benefits, how it’s different from existing liquid staking options, and how you can deposit various liquid staking tokens including osETH, wbETH, rETH, cbETH, stETH, oETH , ankrETH , swETH, ETHx into EigenLayer in a single move on the OPUS Pool.

Liquid staking is a mechanism that enhances traditional staking by introducing liquidity to staked assets. Unlike traditional staking, which necessitates locking up cryptocurrency to support a network’s operations and security, liquid staking allows participants to retain the fluidity of their assets. Through liquid staking, users stake their crypto with a liquid staking protocol and receive a token in return—this token symbolizes the staked amount and any accrued rewards or penalties.

The critical distinction lies in the usability of these new tokens: they can be freely traded or utilized within the DeFi ecosystem, thus allowing stakers to earn additional yields or use them as collateral in various financial protocols. This creates a dual advantage by enabling participation in network validation and security processes, akin to traditional staking, while simultaneously providing liquidity and opportunities to compound rewards in the broader DeFi space.

The OPUS Pool democratizes access to staking rewards by removing barriers such as minimum staking requirements and the need for technical infrastructure, making it an attractive option for a wider range of investors.

The OPUS platform, initially requiring a 32 ETH minimum for validator node operation, has evolved. Now, anyone can stake any amount of ETH (and even restake them) with Chorus One, using our OPUS Pool.

The OPUS Pool, powered by Stakewise smart contracts which have undergone rigorous auditing by esteemed security firms, not only facilitates greater participation in securing the network but also allows a wider range of Chorus One stakers to earn rewards and gain access to a suite of benefits, including top-tier MEV yields, low fees, and the assurance of enterprise-grade security, among others.

As previously mentioned, the OPUS Pool enables any user to stake any amount of ETH and receive rewards instantly. Additionally, users have the ability to mint osETH, a liquid staking derivative, and use it in DeFi or deposit into EigenLayer to gain additional rewards directly on OPUS Pool in one go.

The OPUS Pool sets itself apart from current liquid staking protocols by offering users the advantage of highly competitive staking fees. At just 5%, our fees are among the lowest in the industry, making it more accessible for a broader spectrum of users to stake their ETH and earn rewards.

As pioneers in MEV research, our latest ace, Adagio, is an MEV-Boost client that changes how transactions are handled for increased MEV capture.

Adagio's design allows for more efficient interactions with Ethereum’s transaction supply chain, directly enhancing MEV rewards for stakers. Fully integrated with OPUS Pool validators, Adagio ensures that anyone staking on OPUS Pool can benefit from these increased MEV rewards.

Want to learn more about Adagio and its mechanics? Read all about it here.

OPUS Pool offers a unique feature: users can deposit not only osETH minted through OPUS Pool but also liquid staking derivatives like osETH, stETH, cbETH, and rETH minted on other platforms, directly into EigenLayer.

This flexibility allows users to either mint osETH with OPUS Pool and deposit it into EigenLayer, or bring in any accepted liquid staking derivatives and seamlessly deposit them into EigenLayer in a single step.

Before we delve into the specifics of starting your staking journey with OPUS Pool, let's first understand what restaking is and how it's executed through EigenLayer.

Restaking in the context of Ethereum, as defined by Vitalik Buterin, is a process that allows Ethereum stakers to extend their staked assets' utility beyond the Ethereum network. It means that while your ETH remains staked on Ethereum, you can also leverage its staking power across other blockchain networks. This innovative approach enables new blockchain networks to utilize Ethereum's established validators and staked tokens for securing their trust systems.

Restaking offers stakers the flexibility to contribute to the security of multiple networks, potentially earning rewards, verifying trust, or engaging in blockchain events. It represents an evolution in blockchain participation, broadening the scope and impact of staked assets without requiring additional token allocation.

EigenLayer revolutionizes this concept by implementing smart contracts on Ethereum to facilitate restaking.

It creates a market-driven ecosystem where security is pooled and governed by supply and demand. Users that stake $ETH can opt-in to EigenLayer smart contracts to restake their $ETH and extend cryptoeconomic security to additional applications on the network. Part of EigenLayer’s potential, therefore, lies in its ability to aggregate and extend security through restaking and to validate new applications being built on top of Ethereum.

Actively Validated Services (AVS), essentially new projects or applications building on Ethereum, can tap into this pool, consuming security based on their needs while validators contribute at their discretion, weighing risks and rewards. This system negates the need for AVSs to establish their own validator networks, instead allowing them to utilize Ethereum’s existing security infrastructure.

For a more comprehensive overview of EigenLayer and how it addresses current challenges in Ethereum security, please read our latest blog.

Currently, there are two ways in which you can use the OPUS Pool. The first method involves minting your osETH through OPUS Pool and depositing it directly into EigenLayer, while the second method enables you to skip minting osETH and directly deposit any accept liquid staking tokens (osETH, cbETH, stETH, rETH) directly into EigenLayer on the OPUS Pool.

Both methods are made as simple as possible to enhance your staking experience, and can be completed in just 3 steps, as described below:

Step 1: Connect your wallet on the OPUS Pool page and deposit some ETH into the pool.

Step 2: Once deposited successfully, you can now mint your osETH in 1-click.

Step 3: Deposit your osETH into EigenLayer.

Step 1: Go to the OPUS Pool page, select Restake and connect your wallet

Step 2: Select token of your choice (osETH/stETH/cbETH/rETH ) and enter amount to Restake

Step 3: Deposit your tokens into EigenLayer

Our institutional customers may opt in to leverage the OPUS SDK to integrate ETH staking into their offerings, providing their customers with all the benefits of the OPUS Pool seamlessly.

This allows our institutional client’s customers to benefit from all the features offered by the OPUS Pool, including no minimum ETH required to stake, top tier-MEV yields, high rewards, and direct restaking with EigenLayer.

For a more detailed, step-by-step explanation of how you can stake your ETH and deposit into EigenLayer, please view our guide here.

To start staking on OPUS Pool, visit https://opus.chorus.one/pool/stake/

For institutions interested in learning more about the OPUS Pool SDK, please get in touch with our team at staking@chorus.one

Resources

A step-by-step guide to staking ETH on OPUS Pool

Restake with EigenLayer Seamlessly via Chorus One's OPUS Pool: A Detailed Guide

Learn more about Adagio, Chorus One’s pioneering Ethereum MEV-Boost client

MEV Max - Introducing Chorus One’s Liquid Staking Pool on Stakewise V3

Considerations on the Future of Ethereum Staking

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 50+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

For Chorus One, 2023 was the year of OPUS, our novel multi-chain staking solution.

Following months of dedicated development aimed at simplifying staking for investors, we proudly unveiled our flagship product, OPUS, at the wake of this year.

As the year unfolded, our commitment to perfecting OPUS remained steadfast. We fine-tuned various details, actively sought and incorporated customer feedback, and focused on continuous improvement to ensure that staking is as seamless and stress-free as possible. Below, we share the major highlights from OPUS's journey in 2023.

Dive in!

OPUS is the simplest staking solution for investors and institutions.

Resources:

All you need to know about OPUS: https://docsend.com/view/rye2auvy87hcx8vy

Start staking on OPUS: https://opus.chorus.one/portal/login

Learn more: https://chorus.one/staking-api-opus

When it comes to staking ETH, a recurring challenge arises - the requirement to sign multiple transitions for substantial deposits. This complexity has been especially a persistent hurdle in the path of institutional stakers. To combat this, we’ve devised a solution that streamlines institutional staking: the ability to seamlessly stake 8000ETH , or 250 validators in a SINGLE transaction.

Full details: https://chorus.one/articles/stake-8000eth-in-one-go-with-chorus-one

We launched our liquid staking pool on Stakewise V3, enabling individuals to stake any amount of ETH and benefit from Chorus One’s enterprise-grade staking infrastructure and industry-leading MEV yields!

Additionally, staking on Chorus One’s pool enables users to unstake at any time, or utilize their staked ETH capital throughout DeFi.

You can start staking on our vault here.

To learn more, check out the following resources:

4. We launched the first-ever ‘Bridge & Stake’ solution for DYDX

In tandem with our support for dYdX Chain, we also launched the first ‘Bridge and Stake’ solution for DYDX - enabling users to bridge and stake their tokens from Ethereum to Cosmos in one, single, seamless move.

Full details: https://chorus.one/articles/how-to-bridge-your-dydx-tokens-from-ethereum-to-cosmos

Bridge and Stake your DYDX here: https://opus.chorus.one/portal/dydx

Next, we review the substantial product updates implemented in 2023, driven by customer requests and feedback.

The OPUS dashboard makes it incredibly easy for you to access comprehensive details about your staking rewards, including separate reports that highlight your Execution level, Consensus level, and MEV rewards individually.

In fact, Chorus One stands out as the only node operator equipped with an in-house quant team exclusively focusing on MEV and exploring the intricacies of MEV extraction through evidence-based research. We consistently fine-tune our infrastructure, ensuring seamless integration with the Ethereum MEV pipeline.

Resources:

A sneak peek at validator side MEV optimization

MEV Matters: Decoding Chorus One’s winning MEV strategy

Hedging LP positions by staking

Exploring MEV implications and Cross-Domain dynamics on dYdX v4

Visit our MEV page to learn more: https://chorus.one/mev-maximum-extractable-value

As a user, you can get a comprehensive 360-degree perspective of your ETH stake position on the OPUS dashboard. Instantaneously view your total stake, all-time rewards earned, and validator performance within seconds.

OPUS offers customers a seamless, non-custodial experience for staking, earning rewards, rewards reporting, and unstaking. Our most recent product update from November makes the process of unstaking ETH as smooth as possible.

The OPUS dashboard gives you the freedom to personalize your withdrawal address with the wallet you prefer. Unlike conventional staking platforms, where your connected wallet automatically serves as your withdrawal address, OPUS allows you to set your own preferred withdrawal address.

The OPUS dashboard provides step-by-step guidance throughout the staking process, making it easier for you as the user to grasp and navigate the entire staking journey.

By 2024, OPUS customers will receive periodic automated rewards that will be adjusted for fees on-chain. Say goodbye to manual invoicing!

If you’d like to learn more about OPUS, speak with our team, or start staking with us, please reach out at staking@chorus.one. We look forward to hearing from you.

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.

As another eventful year comes to a close, we're thrilled to present Reflections - a series that rounds up Chorus One's activities in 2023.

The first edition of Reflections takes a look at some of the major company headlines we released throughout the year. Dive in!

Ensuring the security of our customers' assets and information has always been our foremost priority at Chorus One.

In October, we proudly announced a significant milestone in our ongoing commitment to establishing world-class security measures for our customers: the attainment of the ISO 27001:2022 certification - one of the very few node operators in the industry to do so.

Full details: https://chorus.one/articles/chorus-one-achieves-iso-27001-2022-certification-setting-a-major-security-milestone

Visit Chorus One’s security page: https://security.chorus.one/

We launched Red Horizon, a platform designed to streamline developers’ interaction with the Urbit server.

Learn more: https://chorus.one/articles/announcing-red-horizon

Visit the Red Horizon website: https://redhorizon.com

As an industry leader in MEV research, we shared our approach to MEV this year. In the article, also featured by Flashbots’ in their July newsletter edition, we delve into the MEV extraction process, highlight key players, and offer insights into our MEV strategy.

Check it out here: https://chorus.one/articles/mev-matters-decoding-chorus-ones-winning-mev-strategy

We announced our partnership with Ledger, the global security platform for digital assets and NFTs.

Ledger extended its compatibility with the Cosmos ecosystem in May, and Chorus One is currently supporting this integration by providing our validator services, enabling over a million Ledger Live users to leverage the bolstering Cosmos ecosystem and stake numerous tokens, including Onomy (NOM), Quicksilver (QCK), Persistence (XPRT), Injective (INJ) and more through nodes operated by Chorus One.

Learn more: https://chorus.one/articles/ledger-by-chorus-one-securely-stake-your-tokens-via-the-ledger-live-app

Following our mutually co-hosted breakfast side event at Token2049 Singapore, we were pleased to announce a significant milestone in our collaboration with BitGo, a prominent regulated custody, financial services, and core infrastructure provider.

BitGo partnered with Chorus One to expand staking for a diverse range of networks, including Sui, Sei, Injective, Osmosis, and Agoric. This collaboration underscores our longstanding relationship, spanning over a year, and solidifies our position as a preferred staking provider for institutions seeking security, compliance, and cutting-edge research.

Full details: https://chorus.one/articles/chorus-one-partners-with-bitgo-to-expand-staking-for-leading-networks

We announced our partnership with Fordefi, a leading MPC wallet platform and web3 gateway that enables institutions to seamlessly connect to dApps across networks, while securing their digital assets. This partnership currently facilitates Chorus One’s OPUS customers to stake and unstake multiple tokens using the Fordefi wallet inside the OPUS dashboard.

Learn more: https://chorus.one/articles/fordefi-x-chorus-one-direct-staking-for-opus-customers-via-wallet-integration

We announced that Qredo, a premier self-custody protocol and platform, joined forces with Chorus One to expand staking accessibility for investors. From seamless staking to enhanced security measures, this partnership empowers users with a secure and efficient staking experience.

As part of the partnership, Chorus One's OPUS users can directly stake and unstake multiple tokens through Qredo Wallets. This eliminates the complexities associated with managing multiple wallets and platforms, making staking more accessible to a broader range of investors.

Full details: https://chorus.one/articles/qredo-x-chorus-one-providing-enhanced-staking-accessibility

In the interest of safeguarding investors from potential staking penalties, this year we partnered with Nexus Mutual, the leading decentralized coverage provider, to introduce a range of staking coverage options for our customers.

We were the first node operator to purchase on-chain staking coverage to protect our customers through Nexus Mutual’s innovative tokenised cover.

Full details: https://chorus.one/articles/chorus-one-partners-with-nexus-mutual-to-roll-out-industry-wide-on-chain-staking-coverage-2

We provide a glimpse into the results of our first pilot on the Ethereum mainnet, which combines several modifications that positively impact MEV extraction. This piece was also featured by Flashbots' in their November newsletter!

Read it here: https://chorus.one/articles/a-sneak-peek-at-validator-side-mev-optimization

Our research team published a pioneering research report, fueled by a grant from dYdX, that examines the implications of Maximum Extractable Value (MEV) within the context of dYdX v4 from a validator's perspective.

This comprehensive analysis presents the first-ever exploration of mitigating negative MEV externalities in a fully decentralized, validator-driven order book. Additionally, it delves into the uncharted territory of cross-domain arbitrage involving a fully decentralized in-validator order book and other venues.

This paper, marking a significant milestone in exploring MEV dynamics, identifies factors that influence undesirable MEV extraction, and proposes concrete strategies to level the playing field in derivative trading by counteracting such behavior.

Read the report: https://chorus.one/reports-research/mev-on-the-dydx-v4-chain

Report TL;DR: https://chorus.one/articles/exploring-mev-implications-and-cross-domain-dynamics-on-dydx-v4

In January, we released ‘Eth-staking-smith’, an optimized, open-source Ethereum validator key-gen tool to facilitate key and deposit data generation.

The tool, an industry-first, streamlines the often complex Ethereum validator key management process, especially when dealing with it on a large scale.

Learn more: https://chorus.one/articles/a-deep-dive-into-eth-staking-smith

We published a whitepaper comparing key characteristics of Ethereum and Solana, which explores the block-building marketplace model, akin to the "flashbots-like model," and examines the challenges of adapting it to Solana.

Additionally, recognizing Solana's unique features, we also proposed an alternative to the block-building marketplace: the solana-mev client. This model enables decentralized extraction by validators through a modified Solana validator client, capable of handling MEV opportunities directly in the banking stage of the validator. Complementing the whitepaper, we also shared an open-source prototype implementation of this approach.

Learn More: https://chorus.one/articles/solana-mev-client-an-alternative-way-to-capture-mev-on-solana

OPUS is the simplest staking solution for investors and institutions.

Resources:

A guide to OPUS: https://chorus.one/articles/opus-api-what-is-it-and-why-did-we-build-it

All you need to know about OPUS: https://docsend.com/view/rye2auvy87hcx8vy

Start staking on OPUS: https://opus.chorus.one/portal/login

We’re thrilled to have launched our liquid staking pool on Stakewise v3, enabling individuals to stake any amount of ETH and benefit from Chorus One’s enterprise-grade staking infrastructure and industry-leading MEV yields!

Additionally, staking on Chorus One’s pool enables users to unstake at any time, or utilize their staked ETH capital throughout DeFi.

You can start staking on our vault here.

To learn more, check out the following resources:

In September of this year, we made it possible for OPUS users to stake up to 8000ETH in one, single transaction, eliminating the cumbersome process of signing multiple transitions for substantial deposits.

Learn more: https://chorus.one/articles/stake-8000eth-in-one-go-with-chorus-one

Stake on OPUS: https://opus.chorus.one/portal/login

In tandem with our support for dYdX Chain, we also launched the first ‘Bridge and Stake’ solution for DYDX - enabling users to bridge and stake their tokens from Ethereum to Cosmos in one, single, seamless move.

Full details: https://chorus.one/articles/how-to-bridge-your-dydx-tokens-from-ethereum-to-cosmos

Bridge and Stake your DYDX here: https://opus.chorus.one/portal/dydx

We announced staking support for Gnosis Chain (GNO), Onomy (NOM), Mars (MARS), and Kyve Network (KYVE) in the first quarter of 2023. Learn more and find out how you can stake GNO, MARS, or KYVE with Chorus One:

Gnosis Chain: https://chorus.one/crypto-staking-networks/gnosis

Onomy: https://chorus.one/crypto-staking-networks/onomy

Mars: https://chorus.one/crypto-staking-networks/mars

Kyve: https://chorus.one/crypto-staking-networks/kyve

We announced staking support for Aptos (APT), and Sui (SUI) in the second quarter of 2023. Learn more and find out how you can stake each network with Chorus One:

Aptos: https://chorus.one/crypto-staking-networks/aptos-2

Sui: https://chorus.one/crypto-staking-networks/sui-2

We announced staking support for Archway (ARCH), Sei Network (SEI) in the third quarter of 2023. Learn more and find out how you can stake each network with Chorus One:

Archway: https://chorus.one/crypto-staking-networks/archway

Sei: https://chorus.one/crypto-staking-networks/sei

We announced staking support for dYdX Chain (DYDX), Celestia (TIA), and Chainflip (FLIP) in the fourth quarter of 2023. Learn more and find out how you can stake each network with Chorus One:

dYdX Chain: https://chorus.one/articles/chorus-one-announces-staking-support-for-dydx-v4-as-a-genesis-validator

Celestia: https://chorus.one/articles/how-to-stake-tia-celestia

Next Up: Keep your eyes peeled for Edition #2 of our Reflections series, coming soon!

About Chorus One

Chorus One is one of the biggest institutional staking providers globally operating infrastructure for 45+ Proof-of-Stake networks including Ethereum, Cosmos, Solana, Avalanche, and Near amongst others. Since 2018, we have been at the forefront of the PoS industry and now offer easy enterprise-grade staking solutions, industry-leading research, and also invest in some of the most cutting-edge protocols through Chorus Ventures.