Go to https://wallet.keplr.app/chains/axelar, search for Chorus One from the list of validators, and click on it.

Go to https://wallet.keplr.app/chains/axelar, search for Chorus One from the list of validators, and click on it.

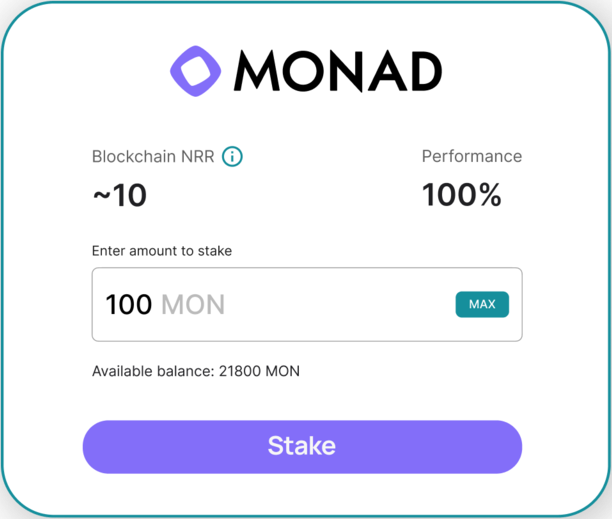

Enter the amount you want to stake (leave some amount in your wallet to pay for the fees)

Click on the Delegate button

Click on Delegate and then Approve the transaction in your wallet/ledger. You're now staking with Chorus One!

A transaction on chain A must be broadcast to the Axelar network when it arrives at the gateway contract. Relayers or cross-chain processes are in charge of monitoring these gateway contracts and relaying any incoming requests to the Axelar network. The validators will then query their RPC endpoints for chain A, vote on the transaction, and initiate an internal state change to complete the transaction. For example, if a transaction puts money into the gateway contract, validators record it and place it in a backlog from which it may be signed by all Axelar validators. Finally, the signed transaction may be relayed to the destination chain by anybody.

The Osmosis DAO voted Axelar to be the main bridge service provider.

Other chains' nodes or light-clients are managed by Axelar network validators. There is no need to write special logic for this; validators just download the software clients given by the blockchain developers, expose RPC endpoints, and link Axelar nodes to those endpoints. Validators will be able to choose which chains to verify requests for, and incentives will be designed appropriately.

Yes, Double Signing comes with a 2% penalty and Downtime with 0.01%.