Digital Asset Treasury Companies (DATs) are redefining corporate treasury management for the blockchain era. By combining traditional finance principles with decentralized technologies, these companies are turning static crypto holdings into productive assets that generate yield, enhance capital efficiency, and contribute to the security of proof-of-stake (PoS) networks.

The opportunity has never been stronger. In the U.S., recent legislative wins, such as the GENIUS Act and the Digital Asset Market Clarity (CLARITY) Act, have provided much-needed regulatory certainty. These laws not only define the oversight roles of the SEC and CFTC, but also clarify that staking activities do not automatically create securities liabilities. This removes a major roadblock for enterprises seeking to generate yield through staking.

From Bitcoin-heavy strategies like Strategy (formerly MicroStrategy), to Ethereum staking specialists like Bit Digital and SharpLink Gaming, to Solana-focused treasuries like DeFi Development Corp, DATs are embracing diverse approaches. Yet the common thread is clear: yield is no longer optional – it’s the core driver of Treasury 3.0.

At Chorus One, we view DATs as pioneers bridging two financial worlds. This article explores how these companies evolved, why yield generation is now imperative, and how secure, compliant staking infrastructure is enabling the next phase of treasury innovation.

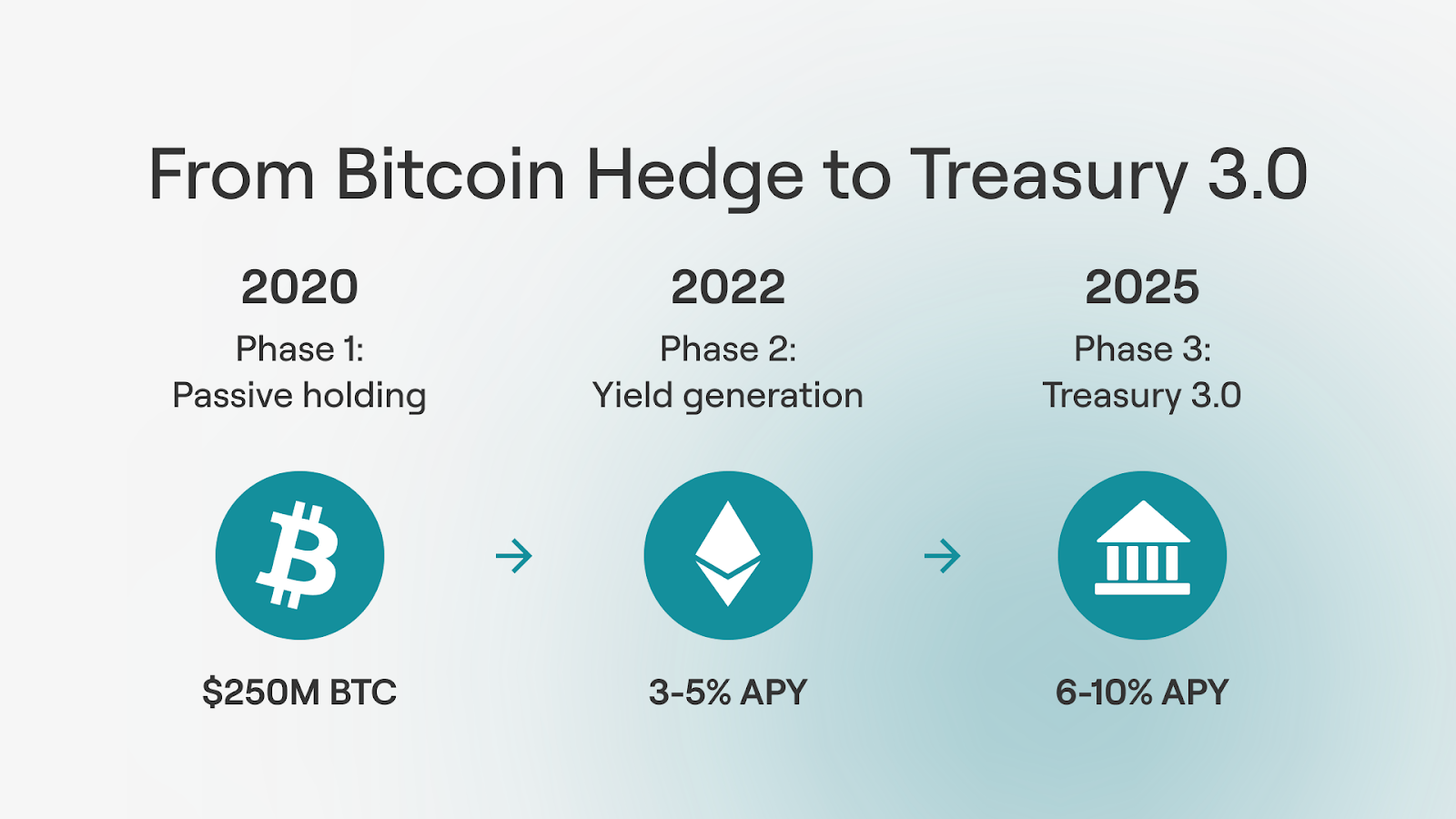

The modern DAT movement began in 2020 when MicroStrategy invested $250 million in Bitcoin, positioning it as a hedge against inflation and currency depreciation. By July 2025, the company had grown its holdings to 601,550 BTC, worth over $70 billion at then-current prices.

Other corporations followed: Tesla, GameStop, and Japan’s Metaplanet among them, primarily focusing on accumulation and long-term appreciation. While effective in bull markets, these strategies left treasuries exposed to volatility.

Ethereum’s September 2022 transition to PoS marked a turning point. Now, holders could earn 3–5% APY simply by staking. Public companies quickly pivoted:

By mid-2025, public companies held 2.33 million ETH worth $8.83 billion.

Today, leading DATs go beyond vanilla staking. They layer liquid staking, restaking, and DeFi integrations to compound returns:

Combined, these strategies can yield 6–10% or more, turning treasuries into dynamic revenue engines.

Want more? To read the full whitepaper by Chorus One's Head of Sales for the Americas and regular Forbes Contributor, Leeor Shimron, and Head of Legal, Adam Sand, follow this link.

We’re thrilled to congratulate Autonity on its mainnet launch, a major step forward in the evolution of decentralized finance infrastructure. As one of the earliest institutional supporters of Autonity, Chorus One is proud to back this groundbreaking Layer 1 blockchain through both strategic investment and hands-on validator participation.

Autonity is not just another EVM-compatible chain. It’s the first Layer 1 purpose-built for decentralized derivatives clearing, introducing an entirely new design space for programmable risk transfer. Developed by Clearmatics, a pioneer in the application of blockchain to financial instruments, Autonity represents a bold vision: building infrastructure that expands the universe of tradable risk far beyond the narrow boundaries of crypto speculation.

At its core, Autonity addresses a fundamental gap in today’s DeFi landscape: the lack of robust infrastructure for derivatives that can track real-world risks — from macroeconomic indicators like inflation to environmental metrics like global temperatures. Traditional finance fails to offer instruments for many of these exposures, while current DeFi platforms are mostly confined to crypto-native assets, plagued by liquidity fragmentation and inefficiencies.

Autonity’s solution is elegant and deeply considered. By decoupling trading venues from the clearing layer via its Autonomous Futures Protocol (AFP), Autonity creates a unified, permissionless clearinghouse for diverse risk markets. Its architecture allows forecast contracts — a new class of fully on-chain derivatives that follow public time series data — to be created, traded, and settled efficiently, opening doors for innovation in quant finance, machine learning, and institutional risk hedging.

Autonity features:

These primitives work together to provide a flexible, secure, and scalable foundation for derivative instruments that can hedge or speculate on almost anything — not just tokens, but real-world metrics.

We’ve been closely involved with Autonity’s development from its earliest stages. As a strategic validator partner, Chorus One participated in over six testnets, helping to validate network performance, test slashing mechanisms, and refine the protocol’s consensus and oracle systems.

Autonity is also a Chorus One Ventures portfolio company. We believe that enabling programmable, decentralized markets for any measurable risk factor is not only the next step in the evolution of DeFi, but also a fundamental leap forward in how we structure global financial systems.

From concept to code to mainnet, the Autonity team has executed with precision, vision, and purpose. As investors and infrastructure partners, we at Chorus One are honored to have supported this journey, and we’re incredibly excited to see what comes next.

Enabling staking on Cosmos has never been easier for institutions. At Chorus One, we’re committed to making staking accessible, secure, and developer-friendly, whether you’re building a dApp, integrating staking into a wallet, or simply looking to support your favourite Cosmos protocol. Our lightweight yet secure SDK empowers you to enable staking across all supported Cosmos SDK-based protocols with less than 10 lines of code. It also underpins Chorus One’s staking dApps for ATOM, TIA, DYDX and more.

Why Cosmos and the Cosmos SDK?

The Cosmos network is celebrated for its interoperability and modular architecture, powered by the Tendermint BFT consensus engine. This foundation allows independent blockchains to communicate and share data seamlessly, all while maintaining their autonomy. Staking is at the heart of Cosmos, securing the network and rewarding those who participate. Our SDK was built to empower Custodians, Exchanges and Wallet Providers to enable their users to access these benefits.

Chorus One SDK: Staking Made Simple

Don’t let the term “SDK” intimidate you. The Chorus One SDK is designed to be intuitive and lightweight. With just a few lines of code, you can:

We’ve successfully implemented Cosmos staking solutions for industry leaders like Ledger and Cactus, proving robust compatibility and reliability.

Seamless Integration: Under 10 Lines of Code

Here’s how easy it is to get started with staking on Cosmos using our SDK:

import { CosmosStaker } from '@chorus-one/cosmos'

const staker = new CosmosStaker({

rpcUrl: 'http://public-celestia-mocha4-consensus.numia.xyz',

lcdUrl: 'https://api.celestia-mocha.com',

bechPrefix: 'celestia',

denom: 'utia',

denomMultiplier: '1000000',

gas: 250000,

gasPrice: '0.4'

})

Tip: The SDK is fully compatible with popular Cosmos libraries like `@cosmjs/cosmwasm`, making integration with existing projects seamless.

Validator Addresses Made Easy

The SDK provides a pre-populated list of Chorus One validator addresses for all supported Cosmos networks:

import { CHORUS_ONE_COSMOS_VALIDATORS } from '@chorus-one/cosmos'

const validatorAddress = CHORUS_ONE_COSMOS_VALIDATORS.COSMOS

Simplified Staking Operations

The SDK simplifies staking on the Cosmos and other networks by offering easy-to-use methods to perform operations such as staking, unstaking, redelegating, and withdrawing rewards. Here’s a simple example of how to build a staking transaction using the SDK:

const { tx } = await staker.buildStakeTx({

delegatorAddress: 'celestia1x88j7vp2xnw3zec8ur3g4waxycyz7m0mahdv3p',

validatorAddress: 'celestiavaloper15urq2dtp9qce4fyc85m6upwm9xul3049e02707',

amount: '1' // 1 TIA

})

Our SDK delivers a comprehensive end-to-end experience, facilitating signing via leading wallets and supporting transaction broadcasting. It’s common for our clients to have these services in-house, reducing the need for duplication. For more information on our adaptable and straightforward signing enablement and broadcasting, please refer to our in-depth documentation.

Why Choose Chorus One SDK?

Ready to enable staking?

With Chorus One, staking on Cosmos is as simple as it gets. Whether you’re building a new dApp, integrating staking into your product, or exploring Cosmos for the first time, our SDK has you covered.

Explore our technical documentation for a deeper dive and start staking today!

A recent proposal from HOTDAO and LiNEAR went live, it suggests cutting NEAR inflation in half. from 5% to 2.5%, which would reduce the annual staking rate to ~4.75% assuming the same staking ratio.

Chorus One has been a validator on NEAR for ±2 years, and one of the most active in terms of governance in PoS networks. We wanted to share some thoughts and feedback around the proposal and its implications for various ecosystem participants. In summary, we acknowledge the motivation and some of the benefits behind reducing base staking rewards, but our view is that the NEAR ecosystem is still too nascent to implement such a drastic change without sufficient time for community discussion. We suggest alternative measures that work towards the same goal, and welcome open feedback from the community.

The primary motivation behind, as stated in the proposal, is to move towards more sustainable economics, as well as incentivizing DeFi participation on NEAR. We previously conducted a similar analysis on SIMD228 and found no definitive conclusion on TVL elasticity towards inflation. For newer ecosystems, this argument should be much weaker as the network has not reached a point where there's sufficient organic economic activity. NEAR’s top 3 LSTs, for instance, only have a combined 1.1% penetration rate.

Despite NEAR’s growth over the past years, the network’s fee generation remains modest relative to its inflation rate. The DeFi ecosystem, while promising, is still maturing and has yet to generate sufficient economic activity to offset a sharp reduction in staking rewards. This is in contrast to mature networks like Solana, which recently also had a proposal that failed to pass, discussing adjusting inflation to a variable rate based on staking participation, which lowers base inflation when staking rates are higher and vice versa. For context, the average monthly Real Economic Value (REV) on Ethereum in H2 2025 was approximately $69.53 million, and Solana averaged $181.8 million. In contrast, Near had around $1.6 million in fees generated, about 43× less than Ethereum and 114× less than Solana. Near’s annual staking reward rate would be lower than Solana’s despite having less economic activity and only marginally higher than Ethereum’s. We are concerned that this disparity could drive stakers to other ecosystems in search of higher rewards and economic activity, ultimately negatively impacting Near.

NEAR currently has 100 active validators proposing blocks, but the top 11 control 33% of the network’s stake. The proposed halving of staking rewards could disproportionately impact smaller validators leading to even more centralization, we’d like to see more initiative on how this would aim to be addressed before. It was mentioned that some modelling and calculations were done around this proposal, we’d love to see the numbers and analysis behind.

Rather than primarily cutting inflation and focusing on the supply side, fostering a vibrant ecosystem through liquid staking and incentivizing active chain usage and the demand side may be more effective. As aforementioned, despite a high inflation rate, LSTs only have 1.1% penetration, which could imply a lack of productive use cases in the ecosystem. Encouraging more on-chain activity and DeFi innovation can organically enhance token value and network health without risking validator attrition.