Chorus One is excited to announce that our validator is live in the active set on Hyperliquid, enabling HYPE staking in partnership with FalconX, a leading institutional digital asset prime broker. This collaboration combines FalconX’s deep liquidity and institutional reach with Chorus One’s proven Proof-of-Stake expertise—making it easier than ever for institutional investors to participate in the growth of the Hyperliquid ecosystem.

Hyperliquid is an EVM-compatible Layer-1 blockchain powered by the HyperBFT consensus mechanism. The network is designed for performance, supporting on-chain trading and applications with the security and reliability expected from institutional-grade infrastructure.

The native token, $HYPE, underpins the staking economy. Holders can delegate without minimum or maximum limits and currently earn an annualized staking reward of approximately 2.10%–2.30%, distributed daily with automatic compounding. For transparency, all network activity can be tracked through the Hypurrscan block explorer. The chain introduces two major architectural innovations:

By joining the validator set, Chorus One brings years of staking expertise to support Hyperliquid’s vision of building the future of on-chain finance. Together with FalconX, we’re extending secure and institutional-grade access to HYPE staking from day one.

Partnering with FalconX ensures institutional clients gain direct access to staking through a platform trusted by some of the world’s largest financial players. With FalconX’s custody integrations and liquidity services, institutions can easily engage with Hyperliquid staking in a secure, compliant, and capital-efficient way.

Chorus One supports institutions through HYPE staking to our public validator, support for White Label validators, HYPE rewards reporting suite and access to our research team's deep expertise on the Hyperliquid ecosystem, including the HIP-3 Standard which allows for the creation of custom perpetual contract markets.

Contact staking@chorus.one or custody@falconx.io for more information on how to stake.

We’re also collaborating with projects building on Hyperliquid, such as leading liquid staking protocols Kinetiq and Hyperbeat, further embedding ourselves in the ecosystem’s long-term growth.

Hyperliquid is redefining on-chain finance by merging the efficiency of centralized platforms with the openness and transparency of blockchain. With Chorus One and FalconX, HYPE staking is now accessible to both retail and institutional users who want to secure the network while earning consistent rewards.

Get started today with Chorus One and FalconX to join the next era of decentralized finance.

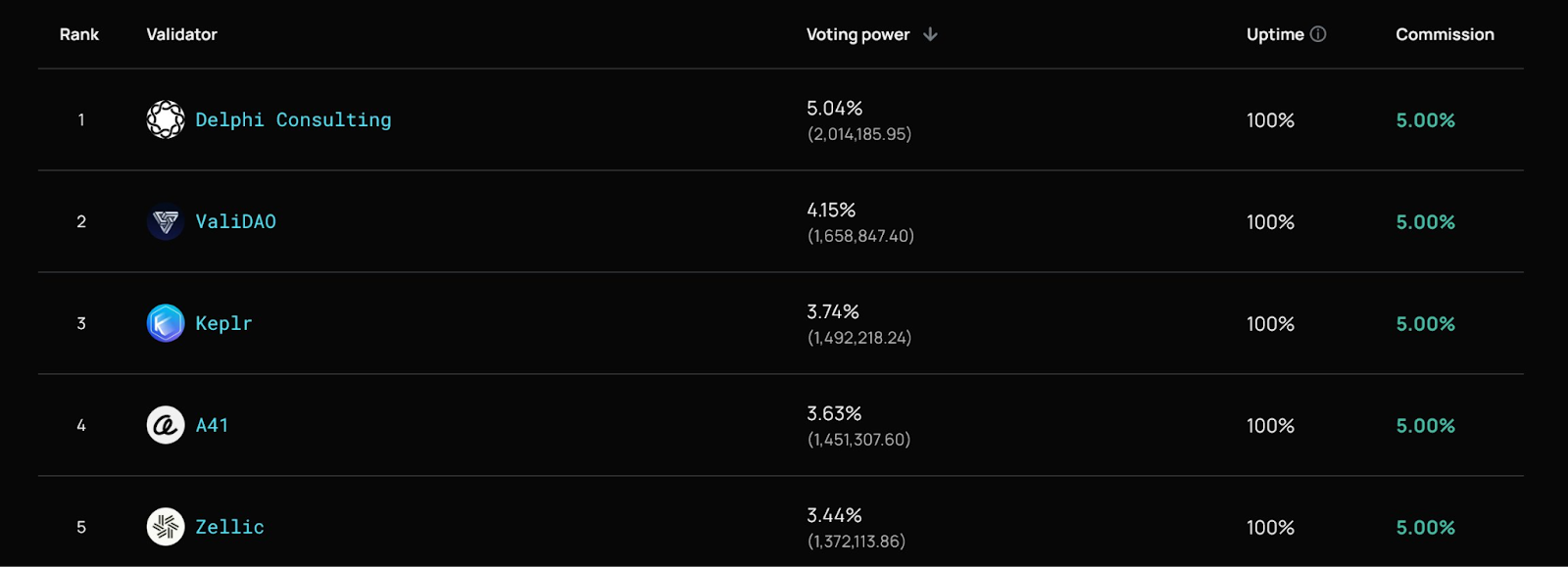

At Chorus One, we believe in the power of aligned, long-term contributions to the networks we serve. That’s why we’re excited to share our latest collaboration: a new institutional-grade validator on Solana, launched in partnership with Delphi Consulting.

This validator isn’t just another node, it’s a reflection of Delphi’s evolving role in Web3 and a continuation of our shared vision: that the most impactful participants in this space are those who contribute beyond capital and research by directly operating critical on-chain infrastructure.

Delphi Consulting, the strategic advisory arm of Delphi Digital, is known for its expertise in token design, economic systems, protocol strategy & GTM, and applied research services. While Delphi Research has long provided market-leading analysis on ecosystems like Solana, Delphi Consulting builds on that foundation to deliver practical, implementation-focused solutions.

Now, they’re taking a natural next step: from protocol insight to protocol participation.

This launch marks the second time Chorus One and Delphi have joined forces on validator infrastructure. Earlier this year, we partnered on a validator for the Initia network, which quickly rose to a top spot in the validator set. That momentum continues now on Solana, one of the highest-throughput networks in crypto.

Solana stands out for its sub-second finality, low fees, and rapidly growing developer ecosystem. With thriving use cases across DeFi, NFTs, payments, and gaming, not to mention innovations like Firedancer and parallelized transaction processing, it’s a network where both scalability and operational precision matter.

At Chorus One, we’ve been running Solana validators since its early days. We're proud to support Delphi’s entry into Solana validation, bringing both institutional-grade performance and principled participation to the network.

This collaboration represents a shared belief that those who understand and invest in protocols should also help operate them. Through partnerships like this one, we want to help set a higher standard for institutional involvement in Web3: informed, hands-on, and aligned with the long-term health of decentralized networks. We look forward to growing this partnership and continuing to help shape the infrastructure backbone of high-performance blockchains like Solana.

Want to support a more decentralized and secure Solana? Stake with the Delphi Consulting validator, powered by Chorus One. 👉 Learn more at https://delphi.link/DelphiConsultingStake

Chorus One Rewards is a unified rewards engine that delivers institutional-grade staking reward tracking across 20+ PoS networks. By consolidating reward types, day-level granularity, transaction logs, and validator commissions into a single platform, it eliminates the need for bespoke queries and manual block explorer reconciliation. Finance and Product Ops teams now have a plug-and-play solution for seamless, auditable reporting—powered by Chorus One’s infrastructure expertise.

Institutions participating in Staking require accurate, detailed, and granular rewards reporting - not just for compliance, but for making informed risk decisions. Without institutional-grade reporting, teams spend hours manually compiling data across block explorers, wrestling with inconsistent formats, and reconciling discrepancies. This time-consuming process creates operational bottlenecks and leaves treasuries vulnerable to reporting errors when assessing validator performance or calculating risk-adjusted returns.

By delivering accurate, verifiable rewards data, we demonstrate our ability to:

Chorus One Rewards tackles the complexity of multichain staking by:

What makes the Chorus One Rewards different from other solutions?

Chorus One’s Rewards is packed with standout features that elevate it above alternative products:

Technical Advantages

Access Chorus One Rewards either directly through our reporting platform or via API for seamless integration into your existing workflows.

Users staking with Chorus One automatically get access to Chorus One Rewards. If you haven’t logged onto the platform yet please:

As corporate treasury strategies evolve beyond Bitcoin, a new era is emerging, where crypto assets are not only held but put to work. In our previous piece, Treasury 3.0: How Digital Asset Treasuries Are Turning Crypto into Yield, we explored how companies began expanding from BTC reserves into yield-generating assets like Ethereum and Solana through staking. Now, as more treasuries adopt active on-chain strategies, including restaking, liquid staking, and DeFi integrations, the pressure is mounting to match these innovations with enterprise-grade reporting. Tracking rewards across dozens of chains, validators, and wallets is a strategic imperative. Without robust, auditable reward data, even the most promising digital treasury strategy can become a liability.

As treasuries shift from passive holding to active reward generation, accurate reporting becomes a key requirement. Every staking reward, restaking payout, or MEV gain constitutes taxable income, potentially with varying fair market values, and protocol-specific nuances. Without a robust system to capture, timestamp, and reconcile these events, finance teams risk producing inaccurate financial statements or triggering red flags with auditors and regulators. The challenge compounds with multichain exposure: fragmented wallets, inconsistent reward structures, and untracked validator commissions all introduce operational noise. High-quality reporting is how treasury teams ensure they’re maximizing yield opportunities, maintaining audit readiness, and preserving institutional trust with stakeholders.

So what defines treasury-grade crypto reporting? It starts with multi-chain coverage and accurate, granular data: daily attribution of rewards, including staking yields, restaking payouts, and MEV income, mapped to the specific wallet, validator, and protocol that generated them. Institutions also need visibility into validator commissions, service fees, and any slashing events that affect net returns. As many treasuries segment assets by fund, business unit, or jurisdiction, reporting must support wallet-level granularity and entity-specific tagging. Just as important is the format: data must enable seamless integration into back office systems, and ultimately align with GAAP or IFRS standards as digital assets are formally recognized in financial reporting frameworks. Fair market value (FMV) at the time of reward is a critical enhancement that enables compliance with IRS Revenue Ruling 2023-14 and emerging EU tax rules under DAC8. Without these capabilities, crypto reporting falls short of the institutional bar.

Consider the journey of a typical corporate treasury evolving its digital asset strategy. In the early phase, the fund holds BTC, tracked through simple ledger tools or custodial statements. But as it adds ETH and begins staking ETH, complexity creeps in. Rewards accrue on-chain, commissions may vary, and new wallets emerge for each protocol. By the time the finance team embraces restaking strategies through EigenLayer or allocates to DeFi vaults, its treasury operations involve dozens of addresses, multiple chains, and a constant stream of taxable events. Without a unified reporting system, the result is fragmented data, error-prone manual reconciliation, and an unreliable audit trail. In contrast, Chorus One’s Rewards Reporting tool provides a single source of truth: dashboards tracking staking and reward activity across multiple chains, daily performance summaries, and downloadable reports ready for fund administrators, auditors, and tax professionals. It enables crypto treasuries to scale with confidence, knowing their yield strategies are matched with enterprise-grade transparency.

Chorus One’s Rewards Reporting is designed to meet the operational and compliance demands of modern crypto treasuries. Its validator monitoring tools allow finance and ops teams to track uptime, reward rate consistency, and restaking activity across 20+ supported protocols, without needing to rely on explorers or raw chain data. Every staking reward is calculated with precision, accounting for validator commissions, service fees, and available rebates to ensure accurate net attribution. And reports can be exported in Excel or CSV formats for seamless integration into existing back off systems ready for accounting systems, fund administrators or auditors.

As crypto treasuries evolve to embrace staking, restaking, and DeFi strategies, the infrastructure that supports them must evolve as well. Sophisticated digital asset strategies demand equally sophisticated reporting tools that deliver precision, transparency, and compliance at scale. With its reporting tool, Chorus One equips institutional teams with the visibility and structure needed to turn raw on-chain activity into actionable financial intelligence. Whether you're optimizing validator performance, preparing for an audit, or reconciling yield across a global treasury, Chorus One ensures that your reporting is as productive and reliable as the assets it supports.