The Stacks ecosystem continues to evolve rapidly as it builds a powerful Bitcoin-aligned smart contract layer. With the launch of Dual Stacking, Stacks introduces one of its most notable protocol improvements to date: a mechanism designed to boost decentralization, improve capital efficiency, and strengthen user participation in securing the network.

At Chorus One, we are pleased to support this upgrade and help institutions and delegators tap into Stacks’ growing ecosystem with the same reliability and operational excellence we bring to all Proof-of-Stake networks.

Dual Stacking is a new mechanism that allows the Stacks network to operate with two simultaneous consensus roles:

In other words, instead of relying solely on STX to secure the network, Stacks introduces a dual-asset participation model where STX and sBTC both play distinct but complementary roles.

This ensures that economic security grows alongside real Bitcoin liquidity entering the ecosystem, aligning incentives more closely with the long-term vision of Bitcoin-anchored smart contracts.

Dual Stacking strengthens the Stacks network by distributing security across two asset types. Instead of relying solely on STX participation, the blockchain now benefits from users who contribute sBTC as well. This approach ties the network’s growth directly to the presence of real Bitcoin liquidity, making the underlying security more resilient and more aligned with Stacks’ long-term vision.

This upgrade offers a more flexible pathway for participation. STX holders can continue stacking as before, locking their tokens to earn BTC rewards contributed by miners. Meanwhile, sBTC holders, who may prefer exposure to Bitcoin rather than STX, gain an entirely new way to contribute to the network’s economic security. This flexibility broadens the potential user base and makes room for different treasury strategies, especially for institutions managing diversified portfolios.

One of the most compelling aspects of Dual Stacking is that it allows participants to keep their assets productive without forcing them into a single asset class. STX holders can continue earning BTC, while sBTC holders can contribute security using a Bitcoin-pegged asset that they may already hold for other purposes. This dual-path approach improves capital efficiency without compromising decentralization or the economic guarantees of the network.

With sBTC becoming a core component of network security, Stacks deepens its commitment to being a true Bitcoin Layer. By allowing a BTC-pegged asset to participate directly in consensus economics, the network becomes even more intertwined with the Bitcoin ecosystem, both technologically and financially.

In practice, Dual Stacking operates through two parallel participation tracks that both contribute to the same consensus process. STX holders lock their tokens in a familiar stacking cycle and earn Bitcoin rewards, just as they do today. Meanwhile, sBTC holders lock their sBTC for a defined period, contributing to network security through a separate mechanism designed specifically for Bitcoin-pegged collateral.

Although the two tracks function differently, they both reinforce the same underlying network guarantees. They also expand the validator and operator environment, creating new responsibilities and opportunities for infrastructure providers like Chorus One.

Chorus One is proud to support Stacks through this transition and help institutions and token holders navigate the opportunities it creates. Our infrastructure is built to meet the demands of high-performance, high-availability networks, and our experience across more than 40 Proof-of-Stake ecosystems positions us to deliver reliable, secure operations for STX stacking, and future Dual Stacking pathways as they become available.

We bring ISO 27001-certified and SOC2 compliant security practices, research expertise, and dedicated institutional support to ensure that participants can engage in Stacks with confidence and clarity.

Dual Stacking marks a milestone for the Stacks ecosystem, introducing a dual-asset model that enhances security, increases flexibility, and directly aligns the network with Bitcoin’s economic gravity. The update creates new opportunities for participants, improves capital efficiency, and positions Stacks for the next phase of growth as a Bitcoin-native smart contract layer.

Chorus One looks forward to supporting this new era and helping institutions and delegators make the most of Stacks’ innovative approach to network participation.

We would like to extend our congratulations to Monad on the successful steps toward its mainnet launch – a milestone that marks the beginning of a new era for high-performance, Ethereum-compatible infrastructure. As the ecosystem prepares for this next chapter, we are excited to announce a new integration with Bitget, one of the world’s leading universal exchanges (UEX), to make Monad (MON) staking accessible to users across global markets.

This collaboration brings together Monad’s breakthrough execution architecture, Bitget’s global reach of 120M users, and Chorus One’s institutional-grade staking expertise, creating a seamless, secure, and highly scalable gateway for early participation in the Monad network.

Monad’s design introduces a leap in execution performance, pairing parallelized transaction processing with MonadBFT consensus to deliver low-latency, high-throughput computation while maintaining full EVM compatibility. As anticipation builds for mainnet, demand for safe, transparent, and reliable staking pathways continues to grow.

However, during Monad’s initial phase, direct staking will be limited, and access will occur primarily through trusted partners. This is where the Chorus One and Bitget integration plays a critical role: it ensures that users can enter the ecosystem through an interface they already trust, backed by infrastructure built for institutional reliability.

Through this integration, Bitget users will gain access to MON staking via Chorus One’s validator infrastructure, benefitting from:

Bitget will route staking operations to Chorus One’s infrastructure, ensuring that delegators participate through a highly resilient validator with a multi-year track record of zero slashing events across 40+ networks.

Staking rewards will be displayed directly within Bitget’s interface, offering a streamlined experience for users who prefer not to manage on-chain delegation flows themselves.

As Monad does not auto-compound staking rewards, users will have the option to manually compound earnings through Bitget’s interface or other integrated tools. This gives full control over reward management while preserving opportunities for optimized yield strategies.

With Bitget’s strong presence in APAC, Europe, and emerging markets, the partnership ensures broad accessibility to MON staking from day one, especially for users who may not otherwise have access to early delegation options.

Complementing the staking integration, Bitget has also launched the MON On-Chain Earn product on November 30. This offering provides users with an accessible way to participate in Monad’s on-chain economy. Users can easily join through Bitget’s dedicated On-Chain Earn interface and start earning on their MON holdings. Click here to join the campaign now!

At Chorus One, our mission is to empower participation in next-generation decentralized protocols through:

For the Bitget integration, we provide infrastructure with continued monitoring, optimization, and reporting to ensure a smooth delegation experience as the ecosystem matures.

Bitget’s influence as a global universal exchange, combined with Chorus One's proven validator track record, helps strengthen the foundation of the Monad network even before its full launch. By lowering the barrier to entry and offering a compliant, scalable on-ramp, this integration helps ensure the validator set grows in decentralization, stability, and geographic diversity.

And as Monad prepares to introduce its high-performance EVM to the world, expanding staking accessibility is a crucial part of building a resilient and secure network from day one.

Monad’s arrival represents a transformative moment for the EVM ecosystem, delivering performance gains without sacrificing compatibility or developer experience. The integration between Chorus One and Bitget is only the first step in a long-term commitment to supporting the network with high-quality staking infrastructure, research insights, and ecosystem collaboration.

We’re proud to contribute to Monad’s journey, and equally proud to help users around the world participate safely and effectively in its early stages.

If you’re a platform, wallet, or institution looking to enable MON staking, our team is ready to support your integration.

Contact us to learn more about partnering with Chorus One for Monad staking.

Amid ongoing efforts to improve scalability and performance in the blockchain industry, Monad - a new EVM-compatible Layer-1 network has been gaining traction. Designed around parallel execution and a unique MonadBFT consensus mechanism, Monad delivers lightning-fast throughput, minimal latency, and the security guarantees needed for global on-chain finance: all while staying fully compatible with Ethereum’s smart contract ecosystem.

At Chorus One, we’re proud to join the Monad validator set from day one. Our goal is to empower both developers and institutions to participate in the network confidently, with reliable staking infrastructure, intuitive tools, and enterprise-grade integrations.

Monad is a high-performance blockchain built to extend Ethereum’s capabilities without sacrificing familiarity. Its architecture introduces parallel transaction execution, allowing multiple smart contracts to process simultaneously — a major leap beyond Ethereum’s single-threaded execution model. This means faster transaction finality, better scalability, and significantly improved user experience.

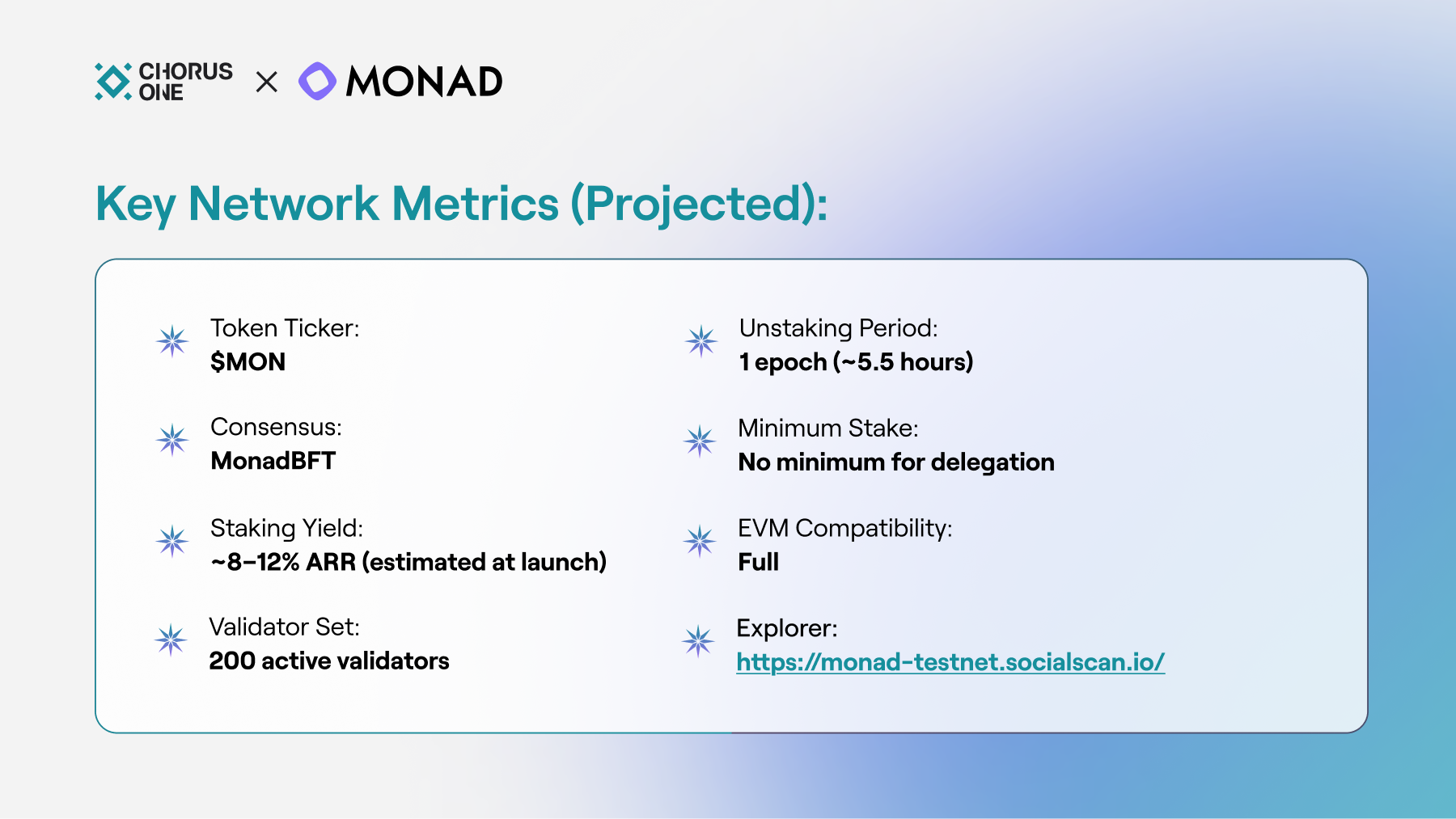

Monad mainnet is expected to launch next MON-day, November 24th, with projected staking rewards of around 8–12% annualized yield. By design Monad does not auto-compound rewards and requires users to claim or compound rewards manually after each epoch.

As MON rewards will not auto-compound. Users must actively “Compound” stake to maximize rewards.

Realizing that this step may result in some users leaving rewards unrealized, Chorus One has built one-click compounding in the staking dApp enabling easy compounding for reward maximization.

Why is compounding important?

Like with any investment, compounding means taking the rewards earned and reallocating them to maximize the reward rate. In staking compounding rewards back to the staked balance ensures they can begin earning rewards as well. While some networks or vault products offer automated auto-compounding, Monad keeps this mechanism fully manual. This approach ensures that users maintain full control over when and how their rewards are restaked – an important detail for institutions that require operational oversight, as well as for users who want to optimize for gas costs or timing.

Another thing to note, as investors won’t be able to stake at launch, early staking access will be facilitated through partner integrations, ensuring secure and compliant participation in Monad’s initial staking phase.

To accelerate the Monad ecosystem from the earliest stages, Chorus One has already launched two core products on the Monad testnet, our SDK and staking dApp, both designed to make participation simple, transparent, and secure.

Our staking dApp is now live on the Monad testnet, allowing users to delegate MON, monitor validator performance, and track rewards in one intuitive interface.

Once Monad mainnet launches, users will be able to:

This dApp demonstrates Chorus One’s commitment to accessibility and transparency, providing a frictionless staking experience for both institutions and individual participants.

As one of the world’s most established staking operators, Chorus One brings a proven record of reliability, security, and institutional trust to the Monad ecosystem.

By staking MON with Chorus One, users not only earn rewards but also contribute to the security and decentralization of the Monad network, helping to build a foundation for scalable, permissionless computation.

Monad is reimagining what’s possible for EVM chains, combining Ethereum-level compatibility with next-generation scalability and performance. Its launch marks an exciting new chapter for builders, investors, and validators seeking high-speed, low-latency blockchain infrastructure.

At Chorus One, we’re committed to ensuring Monad’s success by offering best-in-class validator performance, research-backed insights, and easy-to-integrate staking infrastructure for partners and developers.

Whether you’re building a DeFi application, running a custodian service, or simply exploring Monad’s potential, Chorus One provides the tools and expertise to help you participate securely and effectively from day one.

Chorus One is proud to announce a new partnership with Copper, a leader in digital asset custody, prime services and collateral management, to bring enterprise-ready staking to global clients, beginning with The Open Network (TON). This collaboration combines Copper’s award-winning custody platform with Chorus One’s deep expertise in staking infrastructure, creating a seamless, secure, and scalable solution for institutions.

Both Chorus One and Copper share a commitment to making digital asset participation safe, efficient, and institution-ready. Chorus One brings staking infrastructure and operational excellence, having secured billions of dollars across multiple proof-of-stake networks, and through the partnership Copper will provide robust MPC-based custody and prime services.

Together, this partnership represents a long-term vision to expand institutional access to staking across ecosystems. TON has emerged as a dynamic blockchain ecosystem, with strong momentum in adoption and developer activity. Institutions seeking to participate in TON can now do so with confidence through:

By anchoring the partnership with TON, Chorus One and Copper provide institutions with immediate access to a fast-growing network while laying the foundation for future staking integrations.

This roadmap reflects the partnership’s core mission: to make staking as seamless and trusted for institutions as any other financial service.

With Copper’s secure custody infrastructure and Chorus One’s staking expertise, institutions can gain access to staking solutions that combine operational ease and technical excellence.

The Avalanche Foundation is collaborating with Chorus One to further expand validator infrastructure on the African continent. This step reflects a shared commitment to advancing global decentralization, strengthening geographic diversity, and supporting the long-term resilience of the Avalanche network.

Chorus One has been a trusted partner within the Proof-of-Stake ecosystem and an early supporter of Avalanche since mainnet launch. Together, we are now further extending Avalanche's validator presence to Africa - helping bring the network closer to developers, users, and institutions on the continent.

The Avalanche Foundation’s focus on community growth and network accessibility aligns with Chorus One’s mission of transparency, performance, and inclusion. This collaboration reflects our mutual goal: ensuring that Avalanche remains a resilient, decentralized, and globally distributed network.

The Foundation will continue to work with ecosystem partners like Chorus One to encourage regional participation, broaden community access, and expand developer infrastructure.

To learn more about Chorus One’s Avalanche staking services, visit chorus.one/networks/avalanche.

We would like to thank Keone and the entire Monad team for their valuable discussions and insightful feedback.

The Monad blockchain is designed to tackle the scalability and performance limitations of existing systems like Ethereum. It maximizes throughput and efficiency while preserving decentralization and security. Its architecture is composed of different integrated components: the Monad Client, which handles consensus and execution. MonadBFT, a consensus mechanism derived from HotStuff. The Execution Model, which leverages parallelism and speculative execution, and finally MonadDB, a state database purpose-built for Monad. Additional innovations such as RaptorCast and a local mempool design further enhance performance and reliability. Together, these elements position Monad as a next-generation blockchain capable of supporting decentralized EVM applications with low latency and strong guarantees of safety and liveness. Below, we'll provide a technical overview of the Monad architecture, which consists of the Monad Client, MonadBFT, the execution model, and monadDB.

The Monad architecture is built around a modular node design that orchestrates transaction processing, consensus, state management, and networking. Validators run the Monad Client, a software with a part written in Rust (for consensus) and C/C++ (for execution) to optimize performance. Similar to Ethereum, the Monad client is split into two layers:

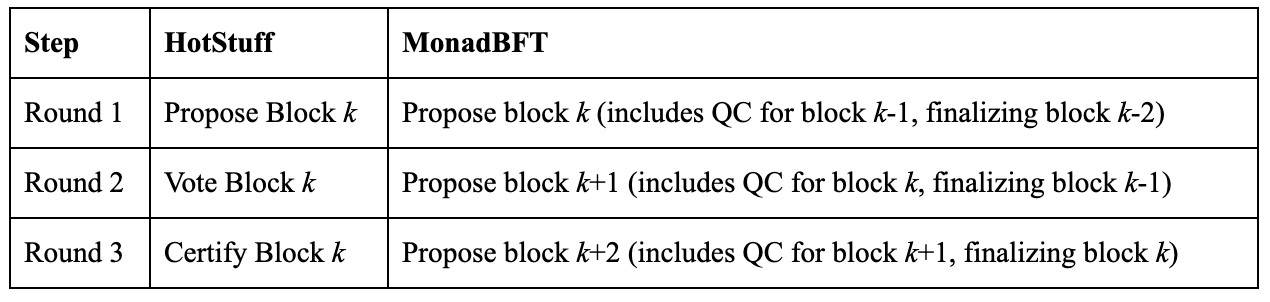

Traditional HotStuff requires 3 phases to finalize a block, each happening one after the other:

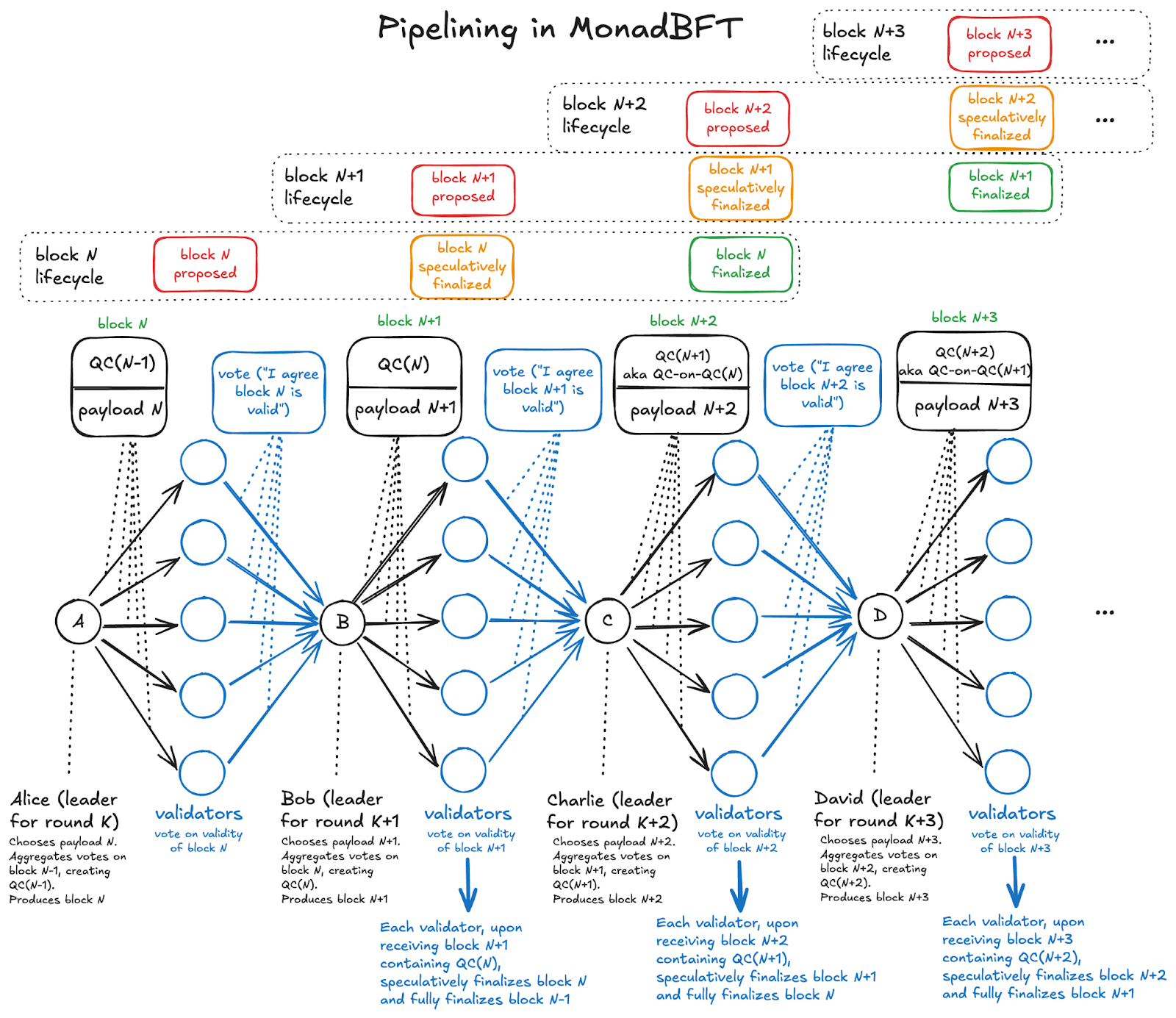

This sequential process delays block finalization. MonadBFT only requires 2 phases, which makes finality faster, but also, it uses a pipelined approach, overlapping phases: when block k is proposed, block k–1 is voted on, and block k–2 is finalized simultaneously. This parallelism reduces latency.

On Monad, at any round, validators propose a new block, vote on the previous, and finalize the one before that.

Comparison: HotStuff vs MonadBFT

The Monad documentation includes a clear infographic illustrating MonadBFT’s pipelined approach, showing how each round overlaps proposal, voting, and finalization to achieve sub-second finality.

Although pipelining increases block frequency and lowers latency, it comes with a big problem that previously hadn’t been addressed by any pipelined consensus algorithms. That problem is tail-forking.

Tail-forking is best explained with an example. Suppose the next few leaders are Alice, Bob, and Charlie. In pipelined consensus, as mentioned before, second-stage communication about Alice's block piggybacks on top of Bob's proposal for a new block.

Historically, this meant that if Bob missed or mistimed his chance to produce a block, Alice's proposal would also not end up going through; it would be "tail-forked" out and the next validator would rewrite the history Alice was trying to propose.

MonadBFT has tail-fork resistance because of a sophisticated fallback plan in the event of a missed round. Briefly: when a round is missed, the network collaborates to communicate enough information about what was previously seen to ensure that Alice's original proposal ultimately gets restored. For more details, see this blog post explaining the problem and the solution.

MonadBFT employs a stake-weighted, deterministic leader schedule within fixed 50,000-block epochs (~5.5 hours) to ensure fairness and predictability:

Unlike older BFT protocols with quadratic (O(n²)) message complexity, MonadBFT scales linearly (O(n)). Validators send a fixed number of messages per round to the current or next leader, reducing bandwidth and CPU costs. This enables 100–200+ validators to operate on modest hardware and with modest network bandwidth limits without network overload.

MonadBFT tolerates up to 1/3 of validator stake being offline while retaining liveness, and up to 2/3 of validator stake being malicious while retaining safety (no invalid state transitions).

To support fast consensus, Monad uses RaptorCast for efficient block propagation. Instead of broadcasting entire blocks, RaptorCast splits blocks into erasure-coded chunks distributed via a two-level broadcast tree:

If a validator lags, it syncs missing blocks from peers, updating its state via MonadDB (see State Management section below). With consensus efficiently establishing transaction order, Monad's execution model builds on this foundation to process those transactions at high speed.

Monad’s execution model overcomes Ethereum’s single-threaded limitation (10–30 TPS) by leveraging modern multi-core CPUs for parallel and speculative transaction processing, as enabled by the decoupled consensus described above.

After consensus, transactions are executed asynchronously during the 0.4 s block window. This decoupling allows consensus to proceed without waiting for execution, maximizing CPU utilization.

With Optimistic Parallel Execution, Monad tries to speed up blockchain transaction processing by running transactions at the same time (in parallel) whenever possible, rather than one by one. Here’s a simple explanation of how it works:

Monad executes all transactions in a block simultaneously, assuming no conflicts, and creates a PendingResult for each, recording the inputs (state read, like pre-transaction account balances) and outputs (new state, like updated balances).

After the parallel execution, Monad checks each PendingResult in order (serially).

This saves time because many transactions don’t conflict, so running them in parallel is faster. Even when transactions conflict (for example: two transfers from the same account), Monad only re-executes the ones that fail the input check, which is usually fast because the data is already in memory.

Here’s a simple example with 4 transactions in a block:

Monad assumes all transactions can run simultaneously and corrects conflicts afterward:

Monad executes all 4 transactions at the same time, assuming the initial blockchain state is consistent for each. It produces a PendingResult for each transaction, recording:

For example:

Monad commits the PendingResult one by one in the order they appear in the block (Tom, Jordan, Alice, Paul). It checks if each transaction’s inputs still match the current blockchain state. If they do, the outputs are applied. If not, the transaction is re-executed.

Let’s walk through the commitment process:

New state: Pool A’s balances are updated, Tom’s balances are updated.

New state: NFT contract state is updated, Jordan owns the new NFT.

New state: Alice and Eve’s MON balances are updated.

New state: Pool A’s balances are updated again, Paul’s balances are updated.

After committing all transactions, the blockchain reflects:

Monad enhances speed via speculative execution, where nodes process transactions in a proposed block before full consensus:

In summary, Optimistic Parallel Execution is about how transactions get processed (running many in parallel to speed up the process) while Speculative Execution handles when processing begins, starting right after a block is proposed but before full network confirmation. This parallel and speculative processing relies heavily on efficient state management, which is handled by MonadDB.

MonadDB improves blockchain performance by natively implementing a Merkle Patricia Trie (MPT) for state storage, unlike Ethereum and other blockchains that layer the MPT on slower, generic databases like LevelDB. This custom design reduces disk access, speeds up reads and writes, and supports concurrent data requests, enabling Monad’s parallel transaction processing. For new nodes, MonadDB uses statesync to download recent state snapshots, avoiding the need to replay all transactions. These features make Monad fast, decentralized, and compatible with existing systems.

Key Features

Role in Execution

MonadDB integrates with Monad’s execution model:

Node Synchronization and Trust Trade-Off

MonadDB enables rapid node synchronization by downloading the current state trie, similar to how git fetch updates a repository without replaying full commit history. The state is verified against the on-chain Merkle root, ensuring integrity. However there is an important trust trade-off:

Monad transparently addresses this trade-off:

Monad optimizes transaction submission and propagation to minimize latency and congestion, complementing MonadBFT and RaptorCast.

Localized Mempools

Unlike global mempools, Monad uses local mempools for efficiency:

This targeted forwarding reduces network congestion, ensuring fast and reliable transaction inclusion.

Overall, Monad's architecture demonstrates how a blockchain can achieve high performance without sacrificing safety. By using MonadBFT, parallel execution, and an optimized database, Monad speeds up block finalization and transaction processing while keeping results deterministic and consistent. Features like RaptorCast networking and local mempools further cut down latency and network overhead. There are trade-offs, especially around fast syncing and trust assumptions, but Monad is clear about them and offers flexible options for node operators. Taken together, these choices make Monad a strong foundation for building decentralized EVM applications, delivering the low latency and strong guarantees promised in its design.

Ethereum staking continues to mature, and institutions with significant ETH holdings are increasingly looking for secure and yield-competitive strategies. At Chorus One, we are building solutions that combine simplicity, flexibility, and performance – allowing our clients to participate in Ethereum’s DeFi ecosystem without added complexity.

Our latest staking product leverages Lido stVaults to deliver two complementary strategies:

This dual approach positions Chorus One to better meet the diverse needs of institutional clients – whether they value simplicity, capital efficiency, or higher returns.

Several factors make stVaults and stETH a natural fit for our institutional staking product:

Security remains foundational to our approach. We are actively testing vanilla and looped staking strategies on testnets to validate reliability, scalability, and client safety.

If custom smart contract development is required, we will follow strict transparency standards by publishing fully public audits. Institutions can also review our broader security framework in our Chorus One Handbook and security documentation.

By integrating stVaults into our staking product suite, Chorus One is unlocking several benefits for institutions:

The launch of stVault-based staking products marks a significant step forward in Chorus One’s institutional offering. By combining the liquidity of stETH with the flexibility of stVaults, we are empowering institutions to access yield opportunities that are both secure and scalable, without unnecessary dependencies.

At Chorus One, we believe the future of ETH staking lies in making institutional participation seamless, capital-efficient, and reward-optimized. stVaults are a key part of that vision.

Chorus One is excited to announce that our validator is live in the active set on Hyperliquid, enabling HYPE staking in partnership with FalconX, a leading institutional digital asset prime broker. This collaboration combines FalconX’s deep liquidity and institutional reach with Chorus One’s proven Proof-of-Stake expertise—making it easier than ever for institutional investors to participate in the growth of the Hyperliquid ecosystem.

Hyperliquid is an EVM-compatible Layer-1 blockchain powered by the HyperBFT consensus mechanism. The network is designed for performance, supporting on-chain trading and applications with the security and reliability expected from institutional-grade infrastructure.

The native token, $HYPE, underpins the staking economy. Holders can delegate without minimum or maximum limits and currently earn an annualized staking reward of approximately 2.10%–2.30%, distributed daily with automatic compounding. For transparency, all network activity can be tracked through the Hypurrscan block explorer. The chain introduces two major architectural innovations:

By joining the validator set, Chorus One brings years of staking expertise to support Hyperliquid’s vision of building the future of on-chain finance. Together with FalconX, we’re extending secure and institutional-grade access to HYPE staking from day one.

Partnering with FalconX ensures institutional clients gain direct access to staking through a platform trusted by some of the world’s largest financial players. With FalconX’s custody integrations and liquidity services, institutions can easily engage with Hyperliquid staking in a secure, compliant, and capital-efficient way.

Chorus One supports institutions through HYPE staking to our public validator, support for White Label validators, HYPE rewards reporting suite and access to our research team's deep expertise on the Hyperliquid ecosystem, including the HIP-3 Standard which allows for the creation of custom perpetual contract markets.

Contact staking@chorus.one or custody@falconx.io for more information on how to stake.

We’re also collaborating with projects building on Hyperliquid, such as leading liquid staking protocols Kinetiq and Hyperbeat, further embedding ourselves in the ecosystem’s long-term growth.

Hyperliquid is redefining on-chain finance by merging the efficiency of centralized platforms with the openness and transparency of blockchain. With Chorus One and FalconX, HYPE staking is now accessible to both retail and institutional users who want to secure the network while earning consistent rewards.

Get started today with Chorus One and FalconX to join the next era of decentralized finance.