As the Tezos protocol evolves, so do our services. In response to the recent Paris upgrade, we’re updating how we operate our Tezos validator (aka Baker).

We will no longer support delegations to our Tezos validator.

TL;DR

Chorus One: tz1eEnQhbwf6trb8Q8mPb2RaPkNk2rN7BKi8 (Explorer)

Chorus One 2: tz1Scdr2HsZiQjc7bHMeBbmDRXYVvdhjJbBh (Explorer)Chorus One: tz1eEnQhbwf6trb8Q8mPb2RaPkNk2rN7BKi8 (Explorer)

For additional information on Delegating versus Staking your XTZ, visit Tezos Docs.

Need help? Contact staking@chorus.one.

Thanks for your continued trust, — The Chorus One Team

Chorus One and Hex Trust are thrilled to announce the expansion of their strategic partnership to unlock institutional access to Stacks (STX) staking, delivering the power of Bitcoin Layer-2 directly into regulated, secure custodial environments.

Unlocking Bitcoin’s Programmable Potential for Institutions

Through this integration, Hex Trust’s institutional clients can now stake STX and earn native Bitcoin rewards via Stacks’ innovative Proof-of-Transfer (PoX) mechanism, all within a fully compliant, bank-grade custody platform. This partnership brings together Hex Trust’s regulated custody expertise and Chorus One’s industry-leading staking infrastructure, empowering institutions to participate in the next evolution of Bitcoin DeFi with confidence.

Key Benefits for Institutional Clients

Why Stacks (STX) Staking Matters

Stacks is the leading Bitcoin Layer-2 protocol, enabling smart contracts and DeFi applications secured by Bitcoin. With STX staking (or “stacking”), institutions can:

How to Get Started

“This partnership is a significant milestone in bringing Bitcoin Layer-2 opportunities to institutional portfolios. By combining Hex Trust’s regulated custody with Chorus One’s secure staking infrastructure, we’re enabling clients to earn BTC rewards and participate in the next wave of Bitcoin innovation, all with the highest standards of security and compliance.” — Joint Statement from Hex Trust & Chorus One Leadership

About Hex Trust

Established in 2018, Hex Trust offers regulated institutional digital asset custody, staking, and markets services to builders, investors, and service providers. For more information, visit Hextrust.com or follow Hex Trust on LinkedIn, X, and Telegram.

About Chorus One

Chorus One is a global leader in institutional staking, operating secure infrastructure across 40+ Proof-of-Stake networks and managing over $2.5 billion in staked assets. With ISO 27001 certification and a track record of innovation, Chorus One empowers institutions to maximize returns and network participation.

Ready to unlock the future of Bitcoin DeFi?

Contact Hex Trust today and start staking STX with confidence.

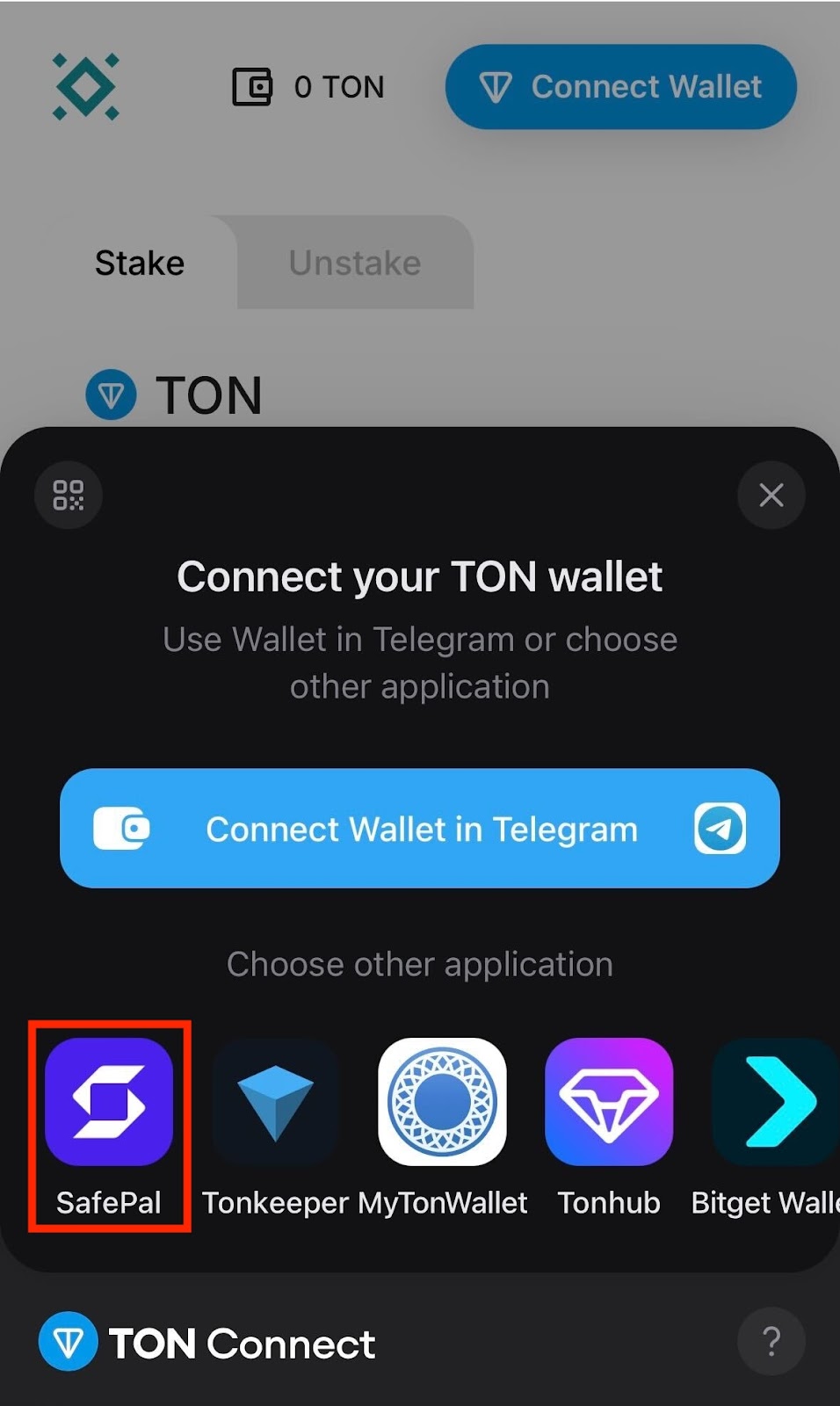

Chorus One is thrilled to announce a major milestone for the TON community: Chorus One’s industry-leading TON Pool is now fully integrated within the SafePal Wallet, unlocking secure, simple and high-performance TON staking for millions of users worldwide.

Elevating TON Staking: SafePal x Chorus One

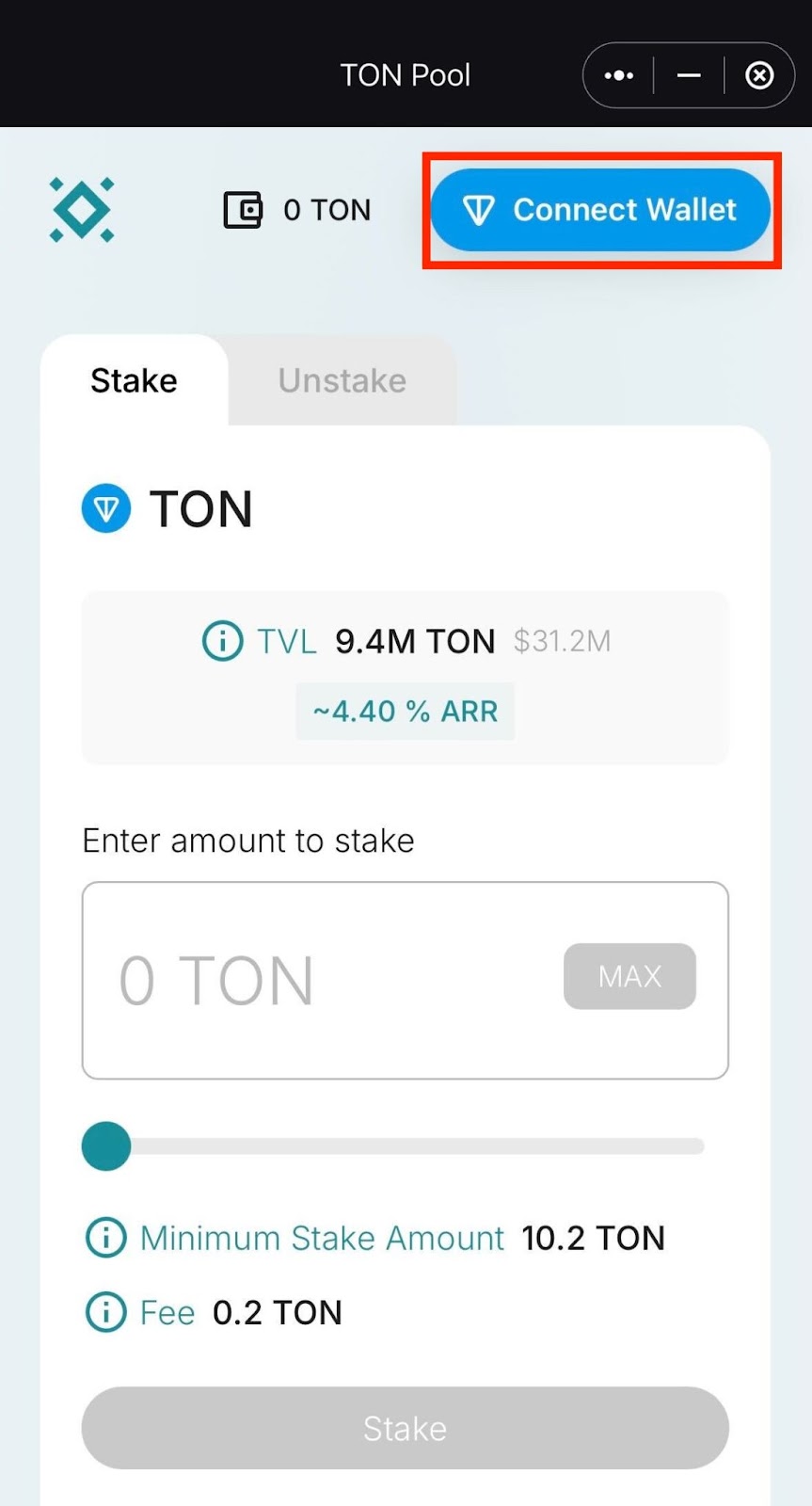

With this integration, SafePal users can now delegate their TON directly to Chorus One’s TON Pool underpinned by robust validator infrastructure without leaving the comfort and security of their SafePal Wallet. Whether you’re safeguarding assets on a hardware device or managing your portfolio via the SafePal mobile app, staking TON has never been easier or more secure.

Key Benefits

Why Chorus One for TON?

Chorus One has rapidly become the staking provider of choice for institutions and individuals seeking reliability, transparency, and top-tier performance. As the TON ecosystem continues its explosive growth driven by deep Telegram integration and a thriving developer community, Chorus One’s TON Pool is setting new standards for security and accessibility.

Highlights of Chorus One’s TON Pool:

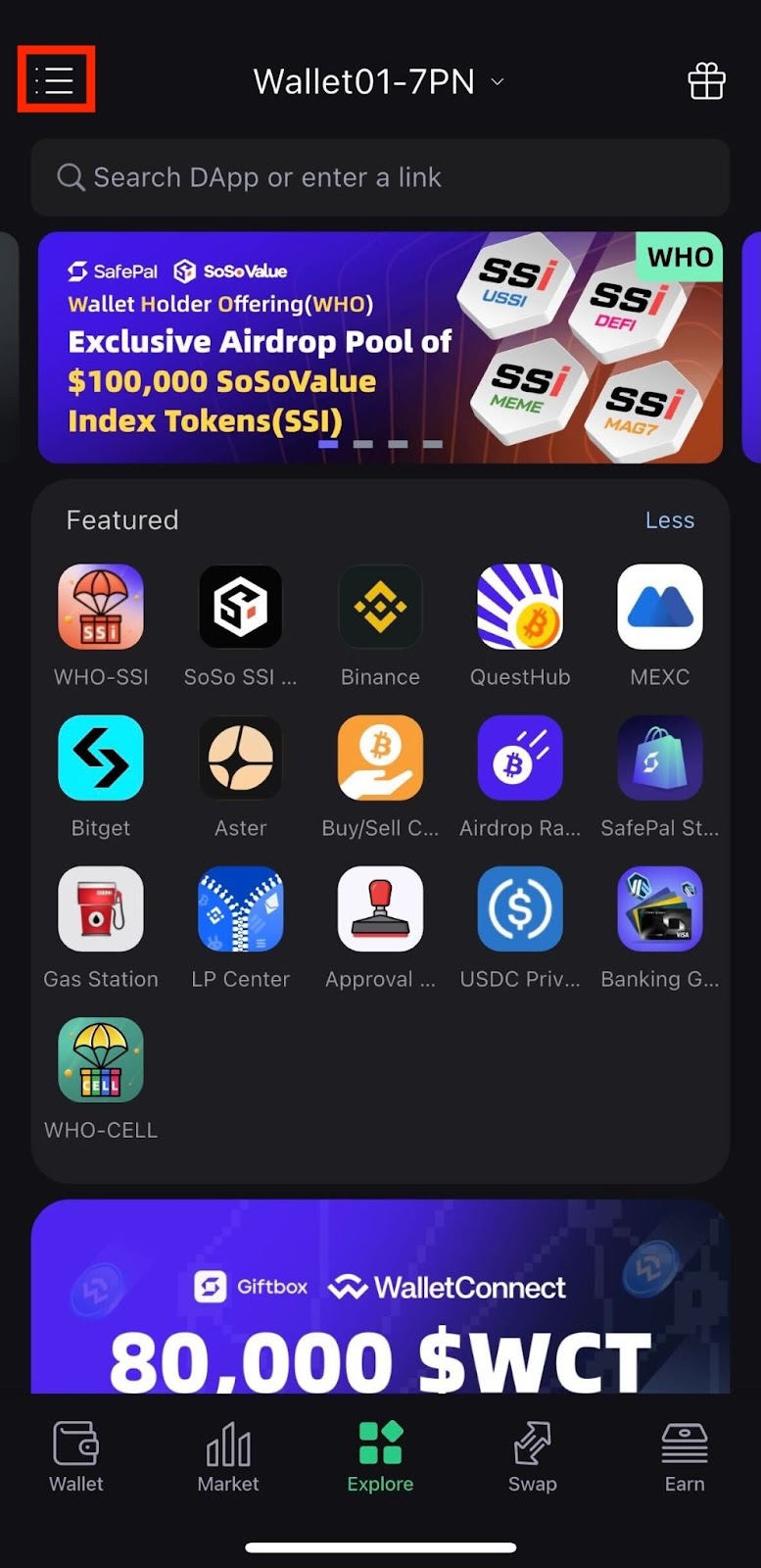

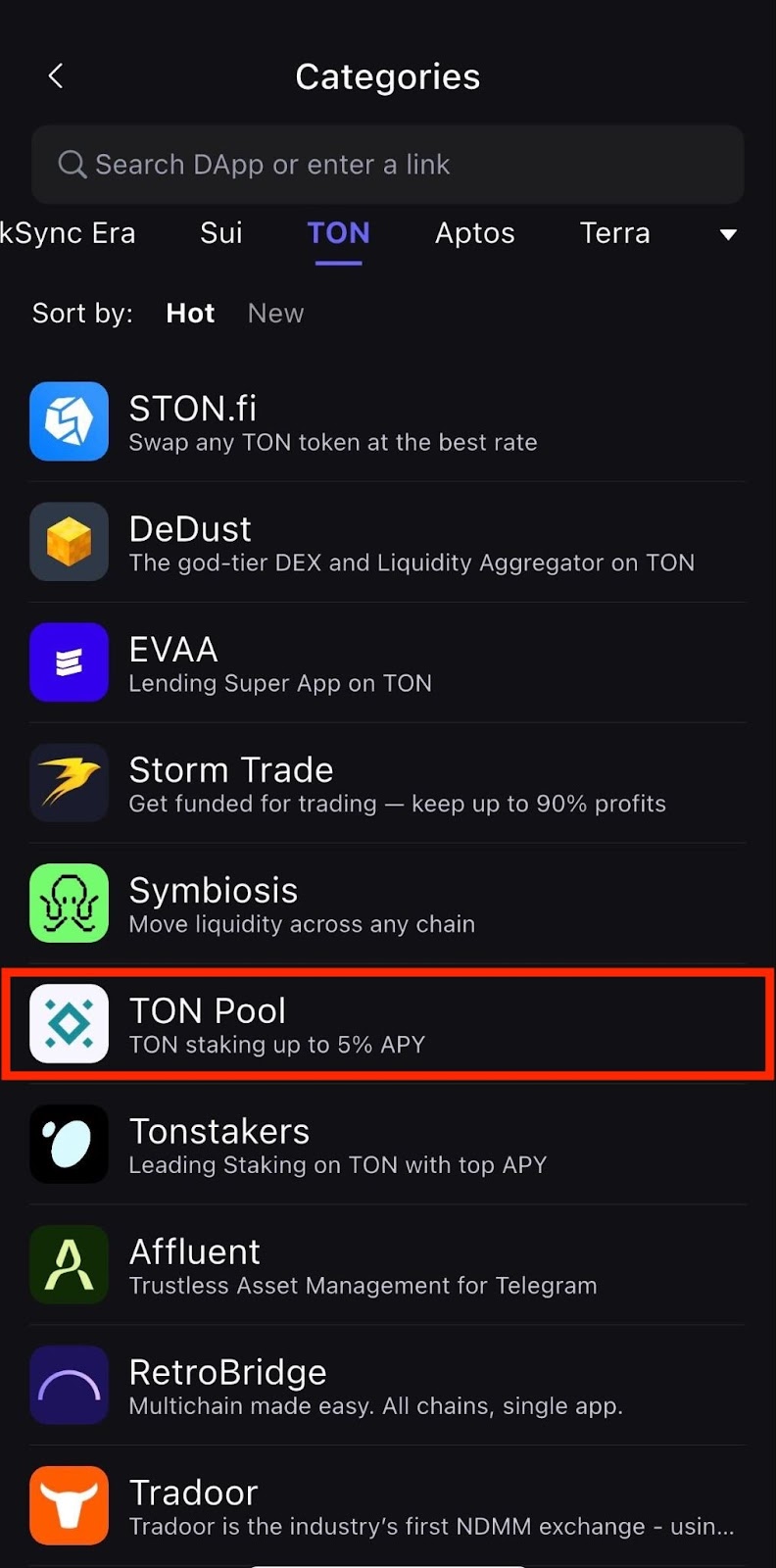

Tutorial - How to Get Started

“Our mission is to make secure staking accessible to everyone, everywhere. Integrating with SafePal brings our trusted TON staking infrastructure to a global audience, empowering users to participate in network security and earn sustainable rewards all from a wallet they know and trust.”

— Brian Crain, Co-Founder & CEO, Chorus One

About Chorus One

Chorus One is a global leader in institutional staking, operating secure infrastructure for over 40 Proof-of-Stake networks, including Ethereum, Solana, Cosmos, Avalanche, and TON. Since 2018, Chorus One has delivered enterprise-grade staking solutions, industry-leading research, and a commitment to the highest standards of security and performance.

About SafePal

SafePal is a next-generation, non-custodial crypto wallet suite serving over 20 million users across 200+ countries. Backed by industry leaders, SafePal empowers users to manage, swap, and stake digital assets securely across 100+ blockchains all from a single, intuitive platform.

Ready to stake TON with confidence?

Open your SafePal Wallet and start earning with Chorus One today!

We’re excited to announce Ledger By Chorus One, a collaborative effort with our long-time partners, Ledger, to continue supporting network security and performance within the Cosmos ecosystem.

Previously, the Cosmos (ATOM) validator node was managed and operated directly by Ledger. With Ledger By Chorus, all operational responsibilities will now be handled by Chorus One, with the new name and Chorus One’s Terms of Service reflecting this transition.

✅ The COSMOS node is now called Ledger By Chorus One, operated by Chorus One.

✅ No interruptions to staking operations—your rewards will continue to accrue and will be claimable as usual.

✅ Chorus One’s Terms of Service will now apply instead of Ledger Live’s Terms of Use. This will have no impact on staking rewards or functionality. To review, click here.

Ledger has chosen Chorus One because of our proven track record securing over 60 proof-of-stake networks, including Cosmos, Ethereum, and Solana. Our ISO 27001-certified infrastructure, 24/7 monitoring, and redundant systems provide the reliability, security, and performance that Ledger—and its users—expect.

Together, we’re combining:

🔐 Ledger’s world-class hardware wallet security — keeping your private keys offline and protected.

⚡ Chorus One’s validator expertise — ensuring your staked ATOM earns consistent rewards with minimal downtime.

🚀 A streamlined staking experience — you can continue to stake and manage your ATOM directly within the Ledger Cosmos wallet, backed by Chorus One’s institutional-grade infrastructure and expertise.

Ledger by Chorus One builds on our history of collaboration and our shared commitment to secure, seamless staking experiences. To learn more about existing Ledger x Chorus One integrations, click here.

Nothing! Your stake stays right where it is, your rewards keep flowing, and you can manage your staking directly in Ledger Live. You can review the new terms and conditions here—please note that no action is required, and there is no time limit.

Should you not agree with the new terms, you may undelegate at any time. For additional details, see Ledger’s Cosmos staking guide here.

With ~6.63 million ATOM staked (worth over $30 million) and representing 2.63% of total voting power, Ledger By Chorus One remains a trusted cornerstone of the Cosmos ecosystem.

We’re proud to work alongside Ledger to deliver best-in-class validator performance and security for Cosmos stakers—today and into the future.

Chorus One is one of the largest institutional staking providers globally, operating infrastructure for over 60 Proof-of-Stake (PoS) networks, including Ethereum, Cosmos, Solana, Avalanche, Near, and others. Since 2018, we have been at the forefront of the PoS industry, offering easy-to-use, enterprise-grade staking solutions, conducting industry-leading research, and investing in innovative protocols through Chorus One Ventures. As an ISO 27001 certified provider, Chorus One also offers slashing and double-signing insurance to its institutional clients. For more information, visit chorus.one or follow us on LinkedIn, X (formerly Twitter), and Telegram.

ABOUT LEDGER

Celebrating its 10 year anniversary in 2024, Ledger is the world leader in Digital Asset security for consumers and enterprises. Ledger offers connected devices and platforms, with more than 7.5M devices sold to consumers in 165+ countries and 10+ languages, 100+ financial institutions and commercial brands. Over 20% of the world’s crypto assets are secured by Ledger.

Ledger is the digital asset solution secure by design. The world’s most internationally respected offensive security team, Ledger Donjon, is relied upon as a crucial resource for securing the world of Digital Assets. With over 14 billion dollars hacked, scammed or mismanaged in 2023 alone, Ledger’s security brings peace of mind and uncompromising self-custody to its community.

Don’t buy “a hardware wallet.” Buy a LEDGER™ device.

LEDGER™, LEDGER LIVE™, LEDGER RECOVER™, LEDGER STAX™, LEDGER FLEX™ and LEDGER FREE FROM COMPROMISE™ are trademarks owned by Ledger SAS

Bluetooth® word mark and logos are registered trademarks owned by Bluetooth SIG, Inc. and any use of such marks by Ledger is under license.

E Ink® is a registered trademark of E Ink Corporation.