As institutional capital enters crypto, SOC 2 has become the baseline language of trust—proving that operational controls are documented, tested, and auditable. But while it validates process integrity, it wasn’t built for blockchain-specific risks like validator uptime, key management, or on-chain resilience. The next evolution pairs SOC 2 with ISO 27001 for continuous risk governance and DORA for regulatory resilience, creating a layered assurance model fit for digital assets. Looking ahead, a “SOC 3.0” paradigm will merge continuous monitoring, cryptographic proofs, and real-time transparency—turning trust from a static audit into a living, verifiable standard for institutional crypto infrastructure.

For digital-asset infrastructure, trust isn’t built on slogans, it’s built on standards. Among those, SOC 2 has become the universal language of operational credibility between crypto-native firms and institutional finance. Originally developed by the American Institute of Certified Public Accountants (AICPA), SOC 2 (System and Organization Controls) reports evaluate how well a company protects data across five “Trust Services Criteria”: Security, Availability, Processing Integrity, Confidentiality, and Privacy.

For traditional finance, SOC 2 has long been the standard for assessing whether vendors operate with robust security and governance. In the digital-asset economy, it now plays a similar role: bridging Web2 assurance frameworks and Web3 infrastructure. When an institutional investor, custodian, or exchange asks whether a staking provider or node operator is SOC 2-certified, they aren’t just checking the boxes, they want to understand reliability, transparency, and the ability to prove control in an environment where capital never sleeps.

The reason this conversation matters now is that the assurance landscape for crypto infrastructure is changing fast. In Europe, the Digital Operational Resilience Act (DORA) will begin enforcement in 2025, requiring continuous monitoring, incident classification, and third-party risk management for all critical ICT providers. At the same time, staking and custody firms across the U.S. and Asia are pursuing SOC 2 Type II and ISO 27001 certifications to meet procurement standards set by institutional allocators and banks. Together, these shifts are raising the bar: compliance is the price of admission to serve institutional capital.

But realistically, SOC 2 alone can’t capture every crypto-specific risk; key management, validator uptime, or smart-contract exposure all remain. But SOC 2 establishes a shared vocabulary of trust that both TradFi and DeFi understand. The challenge ahead, and the opportunity, is to extend that framework into the unique realities of blockchain infrastructure, to make assurance as continuous, transparent, and composable as the systems it governs.

SOC 2 is often described as the “gold standard” for operational assurance, and in many ways, it is. The framework, governed by the American Institute of Certified Public Accountants (AICPA), focuses on how an organization designs and operates its internal controls across five Trust Services Criteria:

These pillars reflect the essentials of trust in modern infrastructure, whether in a data center, a SaaS platform, or a staking service. For crypto and digital asset operators, SOC 2 shows that the organization has implemented, documented, and maintained security and operational processes with the same rigor expected in traditional financial institutions.

There are two key forms of SOC 2 reports:

For institutional partners, the distinction matters. A Type II audit provides evidence not just of policy, but of consistent execution, something risk teams view as critical for ongoing relationships.

However, SOC 2 has a well-defined boundary: it tests control integrity, not resilience or industry-specific adequacy. Organizations define their own controls, and auditors assess whether those controls exist and function as described, not whether they meet a universal security baseline. For example:

This is why SOC 2 is best understood as an attestation of operational maturity, not a certification of invulnerability. It provides essential assurance that controls are in place and working, the minimum entry requirement for institutional trust, but it stops short of enforcing resilience, continuity, or sector-specific standards.

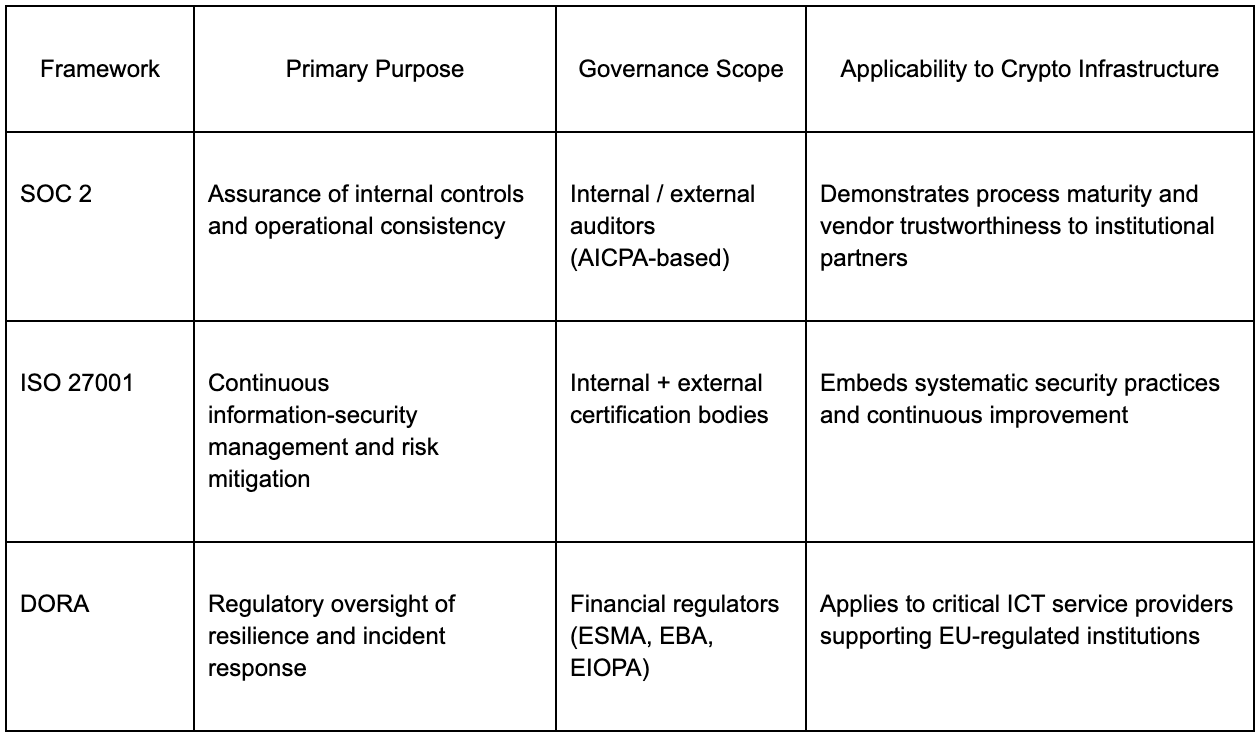

For that reason, leading firms layer SOC 2 alongside frameworks such as ISO 27001, which prescribes a full Information Security Management System (ISMS), and DORA, the EU’s new Digital Operational Resilience Act, which mandates continuous incident reporting, stress testing, and third-party risk oversight for financial entities. Together, these frameworks cover what SOC 2 starts: SOC 2 establishes trust in process, ISO 27001 embeds continuous improvement, and DORA enforces regulatory resilience.

In short:

SOC 2 is the starting line for institutional trust. To turn attestation into resilience, firms pair SOC 2 with ISO 27001 and, in the EU, DORA

In traditional finance, governance frameworks tend to overlap, one defines how you manage risk, another defines what you must protect, and another defines how resilient you must be. In crypto infrastructure, that overlap is starting to take the same form. SOC 2, ISO 27001, and the EU’s Digital Operational Resilience Act (DORA) each play distinct but complementary roles in building institutional-grade security and assurance.

SOC 2 is fundamentally about trust through documentation and execution. It validates that an organization’s internal controls exist, are logically designed, and operate effectively over time. This is why it’s often the first certification sought by digital-asset custodians, staking operators, and exchange infrastructure providers entering institutional partnerships. SOC 2 is non-prescriptive, it doesn’t tell firms which encryption method to use or how to design access control, but it ensures that whatever control framework the company adopts is consistently applied and auditable.

Where SOC 2 stops at control attestation, ISO 27001 begins with systemic governance. Developed by the International Organization for Standardization, ISO 27001 defines a comprehensive Information Security Management System (ISMS), a living framework for assessing, mitigating, and improving security risks across people, processes, and technology. Unlike SOC 2’s periodic audits, ISO 27001 requires ongoing risk assessments, internal audits, and management reviews, embedding security into continuous operations. For institutions, this makes it the global benchmark for “security maturity.”

For crypto firms, particularly those offering infrastructure to regulated banks or funds, ISO 27001 complements SOC 2 by providing:

In practice, many institutions view SOC 2 + ISO 27001 as the combined standard for enterprise-grade crypto infrastructure: SOC 2 gives assurance to auditors and clients; ISO 27001 satisfies risk and compliance teams.

The Digital Operational Resilience Act (DORA), which will take effect across the EU in January 2025, represents the regulatory evolution of these voluntary frameworks. DORA explicitly targets financial entities and their critical ICT providers, imposing mandatory standards for:

Unlike SOC 2 or ISO 27001, DORA is law, not guidance, and its scope extends to critical service providers to regulated institutions. This means staking infrastructure companies, custodians, or blockchain node operators that serve EU-regulated banks may be classified as “critical ICT third parties,” bringing them under direct oversight by the European Supervisory Authorities (ESAs).

In other words:

SOC 2 earns trust.

ISO 27001 builds resilience.

DORA enforces both — under regulatory supervision.

For infrastructure providers like Chorus One, these frameworks work as a progression: SOC 2 establishes procedural trust, ISO 27001 embeds operational discipline, and DORA ensures resilience meets regulatory thresholds. Together, they create a compliance and assurance fabric that speaks both institutional and decentralized languages; aligning crypto infrastructure with the governance rigor expected in modern finance.

SOC 2 has become the passport for trust in digital-asset infrastructure, but it’s only the first chapter in what assurance must become for a 24/7, on-chain economy. The next phase will demand something closer to a “SOC 3.0” standard: one that integrates continuous monitoring, cryptographic verification, and regulatory transparency in real time.

Traditional SOC 2 audits are retrospective snapshots: a look back over six or twelve months to confirm that controls operated as designed. But blockchain infrastructure operates in real time, where validator uptime, MEV execution, or slashing incidents can occur in seconds.

Future assurance models will need to move from static attestations to continuous validation, using telemetry feeds, automated incident reporting, and live dashboards that update an organization’s control status dynamically. This shift mirrors the evolution of DORA’s continuous-resilience mandate and will ultimately bridge compliance with operational reality.

The next generation of assurance will combine conventional audits with on-chain verifiability. Concepts such as Proof-of-Control audits, cryptographic demonstrations that an entity controls validator keys or custody wallets without exposing them, and real-time attestations of uptime, governance participation, and key-management events could make trust both provable and programmable. In this “SOC 3.0” paradigm, auditors can verify it on-chain, linking SOC-style attestations to blockchain-based proofs that anyone can independently confirm.

For regulated institutions, this convergence will make frameworks like SOC 2, ISO 27001, and DORA interoperable.

For staking providers and validators, the benefits go beyond compliance. Real-time proof of validator performance, custody control, and incident transparency can enhance reputation, attract institutional delegations, and even feed into insurance underwriting and risk-weighted capital models.

That’s the future of assurance for crypto infrastructure: a living standard that blends the rigor of traditional compliance with the verifiability of blockchain itself. The path from SOC 2 to some new SOC 3.0 will be about designing trust that updates in real time.

The Avalanche Foundation is collaborating with Chorus One to further expand validator infrastructure on the African continent. This step reflects a shared commitment to advancing global decentralization, strengthening geographic diversity, and supporting the long-term resilience of the Avalanche network.

Chorus One has been a trusted partner within the Proof-of-Stake ecosystem and an early supporter of Avalanche since mainnet launch. Together, we are now further extending Avalanche's validator presence to Africa - helping bring the network closer to developers, users, and institutions on the continent.

The Avalanche Foundation’s focus on community growth and network accessibility aligns with Chorus One’s mission of transparency, performance, and inclusion. This collaboration reflects our mutual goal: ensuring that Avalanche remains a resilient, decentralized, and globally distributed network.

The Foundation will continue to work with ecosystem partners like Chorus One to encourage regional participation, broaden community access, and expand developer infrastructure.

To learn more about Chorus One’s Avalanche staking services, visit chorus.one/networks/avalanche.

We would like to thank Keone and the entire Monad team for their valuable discussions and insightful feedback.

The Monad blockchain is designed to tackle the scalability and performance limitations of existing systems like Ethereum. It maximizes throughput and efficiency while preserving decentralization and security. Its architecture is composed of different integrated components: the Monad Client, which handles consensus and execution. MonadBFT, a consensus mechanism derived from HotStuff. The Execution Model, which leverages parallelism and speculative execution, and finally MonadDB, a state database purpose-built for Monad. Additional innovations such as RaptorCast and a local mempool design further enhance performance and reliability. Together, these elements position Monad as a next-generation blockchain capable of supporting decentralized EVM applications with low latency and strong guarantees of safety and liveness. Below, we'll provide a technical overview of the Monad architecture, which consists of the Monad Client, MonadBFT, the execution model, and monadDB.

The Monad architecture is built around a modular node design that orchestrates transaction processing, consensus, state management, and networking. Validators run the Monad Client, a software with a part written in Rust (for consensus) and C/C++ (for execution) to optimize performance. Similar to Ethereum, the Monad client is split into two layers:

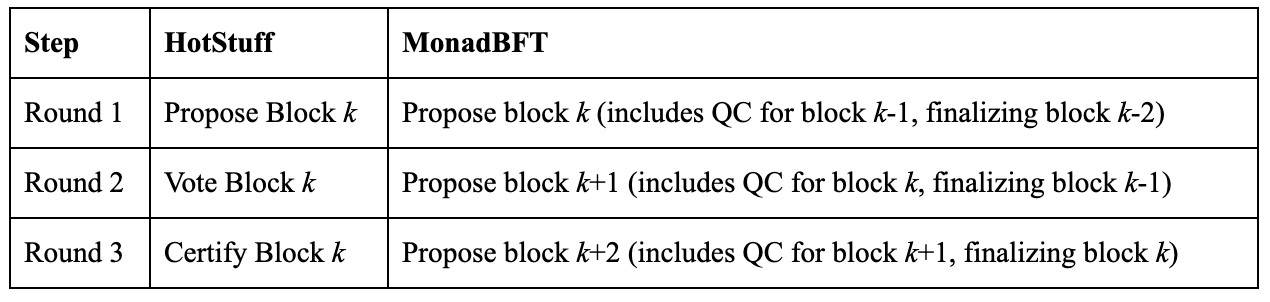

Traditional HotStuff requires 3 phases to finalize a block, each happening one after the other:

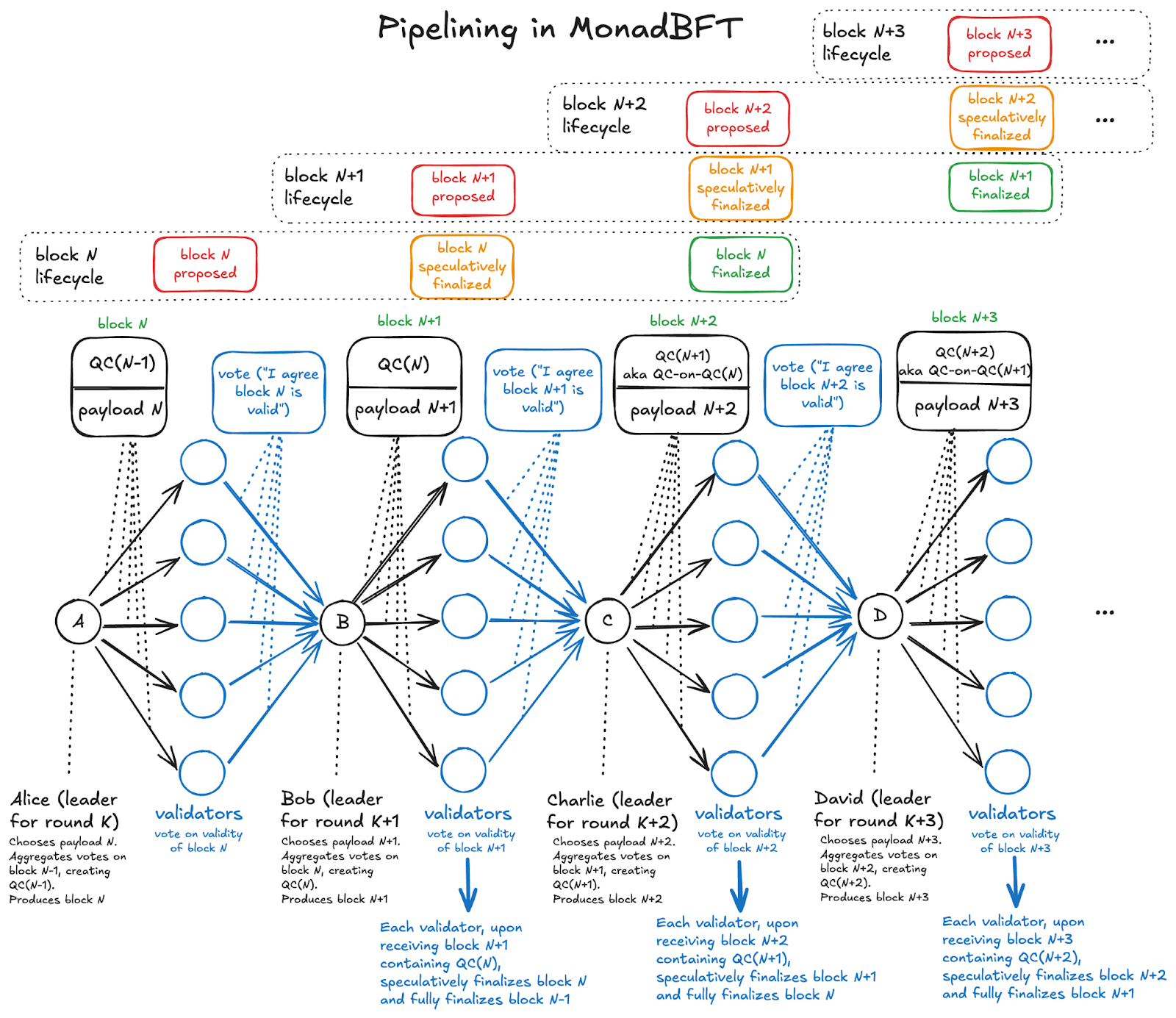

This sequential process delays block finalization. MonadBFT only requires 2 phases, which makes finality faster, but also, it uses a pipelined approach, overlapping phases: when block k is proposed, block k–1 is voted on, and block k–2 is finalized simultaneously. This parallelism reduces latency.

On Monad, at any round, validators propose a new block, vote on the previous, and finalize the one before that.

Comparison: HotStuff vs MonadBFT

The Monad documentation includes a clear infographic illustrating MonadBFT’s pipelined approach, showing how each round overlaps proposal, voting, and finalization to achieve sub-second finality.

Although pipelining increases block frequency and lowers latency, it comes with a big problem that previously hadn’t been addressed by any pipelined consensus algorithms. That problem is tail-forking.

Tail-forking is best explained with an example. Suppose the next few leaders are Alice, Bob, and Charlie. In pipelined consensus, as mentioned before, second-stage communication about Alice's block piggybacks on top of Bob's proposal for a new block.

Historically, this meant that if Bob missed or mistimed his chance to produce a block, Alice's proposal would also not end up going through; it would be "tail-forked" out and the next validator would rewrite the history Alice was trying to propose.

MonadBFT has tail-fork resistance because of a sophisticated fallback plan in the event of a missed round. Briefly: when a round is missed, the network collaborates to communicate enough information about what was previously seen to ensure that Alice's original proposal ultimately gets restored. For more details, see this blog post explaining the problem and the solution.

MonadBFT employs a stake-weighted, deterministic leader schedule within fixed 50,000-block epochs (~5.5 hours) to ensure fairness and predictability:

Unlike older BFT protocols with quadratic (O(n²)) message complexity, MonadBFT scales linearly (O(n)). Validators send a fixed number of messages per round to the current or next leader, reducing bandwidth and CPU costs. This enables 100–200+ validators to operate on modest hardware and with modest network bandwidth limits without network overload.

MonadBFT tolerates up to 1/3 of validator stake being offline while retaining liveness, and up to 2/3 of validator stake being malicious while retaining safety (no invalid state transitions).

To support fast consensus, Monad uses RaptorCast for efficient block propagation. Instead of broadcasting entire blocks, RaptorCast splits blocks into erasure-coded chunks distributed via a two-level broadcast tree:

If a validator lags, it syncs missing blocks from peers, updating its state via MonadDB (see State Management section below). With consensus efficiently establishing transaction order, Monad's execution model builds on this foundation to process those transactions at high speed.

Monad’s execution model overcomes Ethereum’s single-threaded limitation (10–30 TPS) by leveraging modern multi-core CPUs for parallel and speculative transaction processing, as enabled by the decoupled consensus described above.

After consensus, transactions are executed asynchronously during the 0.4 s block window. This decoupling allows consensus to proceed without waiting for execution, maximizing CPU utilization.

With Optimistic Parallel Execution, Monad tries to speed up blockchain transaction processing by running transactions at the same time (in parallel) whenever possible, rather than one by one. Here’s a simple explanation of how it works:

Monad executes all transactions in a block simultaneously, assuming no conflicts, and creates a PendingResult for each, recording the inputs (state read, like pre-transaction account balances) and outputs (new state, like updated balances).

After the parallel execution, Monad checks each PendingResult in order (serially).

This saves time because many transactions don’t conflict, so running them in parallel is faster. Even when transactions conflict (for example: two transfers from the same account), Monad only re-executes the ones that fail the input check, which is usually fast because the data is already in memory.

Here’s a simple example with 4 transactions in a block:

Monad assumes all transactions can run simultaneously and corrects conflicts afterward:

Monad executes all 4 transactions at the same time, assuming the initial blockchain state is consistent for each. It produces a PendingResult for each transaction, recording:

For example:

Monad commits the PendingResult one by one in the order they appear in the block (Tom, Jordan, Alice, Paul). It checks if each transaction’s inputs still match the current blockchain state. If they do, the outputs are applied. If not, the transaction is re-executed.

Let’s walk through the commitment process:

New state: Pool A’s balances are updated, Tom’s balances are updated.

New state: NFT contract state is updated, Jordan owns the new NFT.

New state: Alice and Eve’s MON balances are updated.

New state: Pool A’s balances are updated again, Paul’s balances are updated.

After committing all transactions, the blockchain reflects:

Monad enhances speed via speculative execution, where nodes process transactions in a proposed block before full consensus:

In summary, Optimistic Parallel Execution is about how transactions get processed (running many in parallel to speed up the process) while Speculative Execution handles when processing begins, starting right after a block is proposed but before full network confirmation. This parallel and speculative processing relies heavily on efficient state management, which is handled by MonadDB.

MonadDB improves blockchain performance by natively implementing a Merkle Patricia Trie (MPT) for state storage, unlike Ethereum and other blockchains that layer the MPT on slower, generic databases like LevelDB. This custom design reduces disk access, speeds up reads and writes, and supports concurrent data requests, enabling Monad’s parallel transaction processing. For new nodes, MonadDB uses statesync to download recent state snapshots, avoiding the need to replay all transactions. These features make Monad fast, decentralized, and compatible with existing systems.

Key Features

Role in Execution

MonadDB integrates with Monad’s execution model:

Node Synchronization and Trust Trade-Off

MonadDB enables rapid node synchronization by downloading the current state trie, similar to how git fetch updates a repository without replaying full commit history. The state is verified against the on-chain Merkle root, ensuring integrity. However there is an important trust trade-off:

Monad transparently addresses this trade-off:

Monad optimizes transaction submission and propagation to minimize latency and congestion, complementing MonadBFT and RaptorCast.

Localized Mempools

Unlike global mempools, Monad uses local mempools for efficiency:

This targeted forwarding reduces network congestion, ensuring fast and reliable transaction inclusion.

Overall, Monad's architecture demonstrates how a blockchain can achieve high performance without sacrificing safety. By using MonadBFT, parallel execution, and an optimized database, Monad speeds up block finalization and transaction processing while keeping results deterministic and consistent. Features like RaptorCast networking and local mempools further cut down latency and network overhead. There are trade-offs, especially around fast syncing and trust assumptions, but Monad is clear about them and offers flexible options for node operators. Taken together, these choices make Monad a strong foundation for building decentralized EVM applications, delivering the low latency and strong guarantees promised in its design.

For many years, corporate treasury strategies were very predictable: cash, bonds, and money market instruments. But the world shifted in 2020 when MicroStrategy made waves by placing Bitcoin squarely on its balance sheet as an offensive strategy. Now, with Bitcoin now firmly established in many corporate reserves, a new paradigm is emerging: companies are embracing proof-of-stake assets, starting with Ethereum, to earn yield while staking. This marks a critical shift in how companies think about treasury management in the digital age.

MicroStrategy led the charge in August 2020 with an initial $250 million BTC purchase, framing Bitcoin as a strategic hedge against inflation and depreciation. By late 2024, MicroStrategy had amassed over 423,650 BTC, now valued at $42 billion, making it the largest corporate BTC holder. Corporate Bitcoin accumulation has spread rapidly: 61 public firms now hold more than 3.2% of total BTC supply with companies such as Tesla, GameStop, Riot Platforms, and Twenty One Capital all including Bitcoin in their treasuries. By mid 2025, private and public entities reportedly held more than 847,000 BTC.

As BTC led the digital treasury charge, Ethereum emerged as a compelling next step, offering staked yield plus utility via smart contracts.

These moves reflect a broader cell-level strategy: shifting from purely speculative assets to productive assets that deliver yield while supporting growing digital ecosystems.

Institutional custodial and infrastructure support has become the bedrock of credible crypto treasury strategies. Major players like Coinbase Custody, Anchorage Digital, Fireblocks, and BitGo now offer enterprise-grade custody and staking services tailored to institutional clients. For example, BitGo provides multisignature cold storage and staking support across numerous networks, managing approximately one‑fifth of on‑chain Bitcoin transactions by value. Anchorage Digital, a federally chartered crypto bank, and Fireblocks, recently approved by New York regulators, are now integrated into services like 21Shares’ spot BTC and ETH ETFs alongside Coinbase, further reinforcing industry-grade security and operational compliance. On top of custody, Validator-as-a-Service (VaaS) providers, including Chorus One, Figment, and Kiln, deliver staking infrastructure with service-level guarantees, compliance tooling, and risk mitigation capabilities to allow corporations to operate node infrastructure or delegate responsibly without needing internal DevOps teams, preserving security while capturing staking yields.

Regulatory clarity is also catching up. The IRS issued Revenue Ruling 2023‑14 on July 31, 2023, confirming that staking rewards are taxed as ordinary income once received by cash-method taxpayers under Section 61(a). Complementing this, the SEC has signaled openness to compliant staking frameworks as custodians partner with spot ETF issuers, reinforcing governance and audit controls. Looking ahead, the proposed Digital Asset Market Clarity Act of 2025 (CLARITY Act) would further strengthen this landscape by formally demarcating regulatory jurisdictions: assigning digital commodities such as ETH and SOL to the Commodity Futures Trading Commission (CFTC) while affirming the SEC’s oversight of securities. It would also clarify that mature, protocol-native tokens and DeFi protocols are not investment contracts and further supports institutional use of on‑chain strategies, but also promises to unlock structured layers like restaking, vaults, and LST integrations while preserving board-level governance, audit trails, and operational transparency.

Producing real returns while signaling innovation, staking ETH and SOL offers public companies an attractive alternative to low-yield corporate cash or stablecoin reserves. Profitable yields of 3–7% APY are now accessible through institutional staking platforms, easily outperforming many fixed-income rates. Holding programmable assets also facilitates strategic optionality, enabling treasurers to engage with DeFi use cases, tokenize balances, or even pilot vendor fee settlements with smart contracts.

Beyond financial results, corporate treasury adoption of productive crypto signals clear differentiation to investors. A leading example is SharpLink Gaming, which converted a significant portion of its capital into Ethereum and staked over 95% of it. The firm credits this strategic shift, and the appointment of Ethereum co-founder Joseph Lubin to its board, for signaling innovation and advancing its market positioning.

Looking Ahead

The evolution of corporate crypto treasuries is unfolding in clearly defined phases, each building upon the last in sophistication and capital efficiency. The first phase, Bitcoin pioneering, emphasized symbolic value and digital gold positioning. This was followed by the productive digital assets phase, where firms began to allocate into Ethereum (ETH) and Solana (SOL), not just for exposure but also for the ability to earn staking rewards, thereby generating yield from idle capital. And now, we are entering the multi-layer yield phase, in which forward-looking treasuries are layering on liquid staking, restaking protocols, and decentralized finance (DeFi) integrations to unlock additional yield and liquidity while retaining principal exposure. As regulatory frameworks solidify and infrastructure scales, expect more corporate treasurers to move from storing value to building yield-generating digital treasury architectures.